“Quality, not quantity” is usually a guiding principle for effective content strategies. But in today’s data-saturated world, wealth management firms are instead often tempted to opt for the bombardment approach, making it difficult for clients to distinguish the “need to know” from the irrelevant.

Yet for the most valued clients—the ultra high net worth (UHNW) with over $10 million in investable assets—high quality information has never been so important. Our recent research shows those at the upper end of the wealth curve are increasingly risk averse and so actively seek detailed insights about their investments. To support clients better, advisors will need to share portfolio data more often as well as demonstrate secure technology and robust suitability processes.

Through more effective communication, wealth managers have an opportunity to build closer relationships with UHNW clients. The challenge is to walk the line between sharing content more frequently and provoking “information fatigue.”

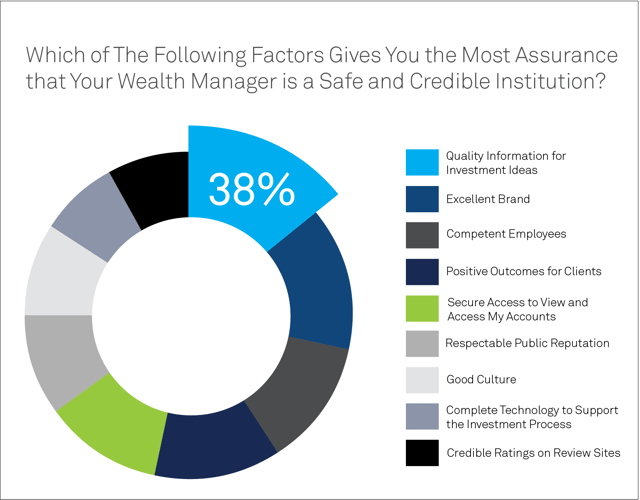

Quality Information Is Critical for Credibility

Working with a safe and trustworthy wealth manager is paramount and clients often rely on everyday interactions to evaluate whether their advisors fit the bill.

Yet the ultra audience is distinct for focusing on different signals to other HNW clients. They prioritize high quality content more than their individual relationships with wealth managers or public reputation.

In fact, investment information is seen as the most reassuring signal of credibility (38% of responses), as it offers clarity on the ideas recommended by advisors. Impressive track records are no longer enough to inspire confidence in proposed strategy; UHNW clients want to understand in depth how future returns will be sourced. Their focus on content contrasts sharply with less wealthy clients who draw on their personal experiences with a firm’s employees to guide their impressions (40%).

In reality, the importance of quality information is even more fundamental to the wealthiest investors. The vast majority would not work with an advisor who isn’t capable of communicating this insight effectively. Four in five believe their primary financial manager is enabled during the investment process by quality information, communication tools, and technology. These are the minimum criteria that wealth managers need to fulfill to even be considered.

Risk Aversion on the Rise

UHNW investors may be the most successful client segment in financial terms but they also tend to be the most risk averse. When asked to identify their dominant concern in an investment scenario, 45% cite safety of the principal, compared with only 24% of those with under $3 million. Just one in five believes that moderate risk is acceptable to increase growth opportunities; at the lower end of the wealth scale, the figure rises to one in three.

With trust in financial institutions running low since the global crisis, deca-millionaires have sharply escalated their expectations of wealth managers. These clients overwhelmingly demand proof that their money is in safe hands.

When asked to define their regulatory priority, 84% cite oversight that their advisors have the right technology to manage their wealth securely. Four in five want firms to be required to demonstrate their investment process. They also want evidence that recommendations match their risk profile (78% of UHNW responses).

For the ultra audience, proof of commitment to fundamental principles of advisory interactions—such as safety and quality of advice— –is now a necessity.

Back to First Principles

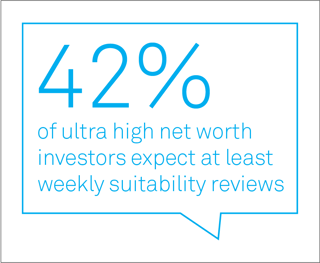

With risk increasingly on their minds, UHNW clients have also changed their expectations around suitability more than others; 63% now expect their risk profile to be evaluated on at least a monthly basis, compared with 45% of the high net worth sample. In fact, 42% of ultra clients want this to happen at least weekly, making this segment nearly as demanding as the millennial generation (46%).

With risk increasingly on their minds, UHNW clients have also changed their expectations around suitability more than others; 63% now expect their risk profile to be evaluated on at least a monthly basis, compared with 45% of the high net worth sample. In fact, 42% of ultra clients want this to happen at least weekly, making this segment nearly as demanding as the millennial generation (46%).

Yet advisors are not accounting for these concerns in their communication strategies. Most wealth managers offer information to clients on a protracted cycle, which simply adds to the anxiety.

Across the high net worth sample, 52% receive progress updates on goal attainment once a month or once a quarter. Information on investment ideas and news on portfolio securities are provided at a similar frequency. Given looming uncertainty, advisors will have to overhaul the slow pace of information exchange to meet evolving needs.

Key Takeaways

For wealth managers, the course of action is clear. To be forewarned is to be forearmed and high quality investment information supports risk mitigation. As a priority, they must provide better visibility of portfolio composition and performance. They could also take the opportunity to demonstrate that their investment methodology and technology are robust.

The challenge is to increase the frequency of these updates while respecting client wariness of communication overload. But by conveying the content UHNW investors value most, advisors will find their most important audience already eager to start the conversation.

For more on this topic, download our eBook: 10 Calls to Action for Wealth Management

You can also learn more about how CTOs are encouraging advisors and their teams to experiment with tools, share experiences, and learn from each other in our most recent wealth research series, available below.