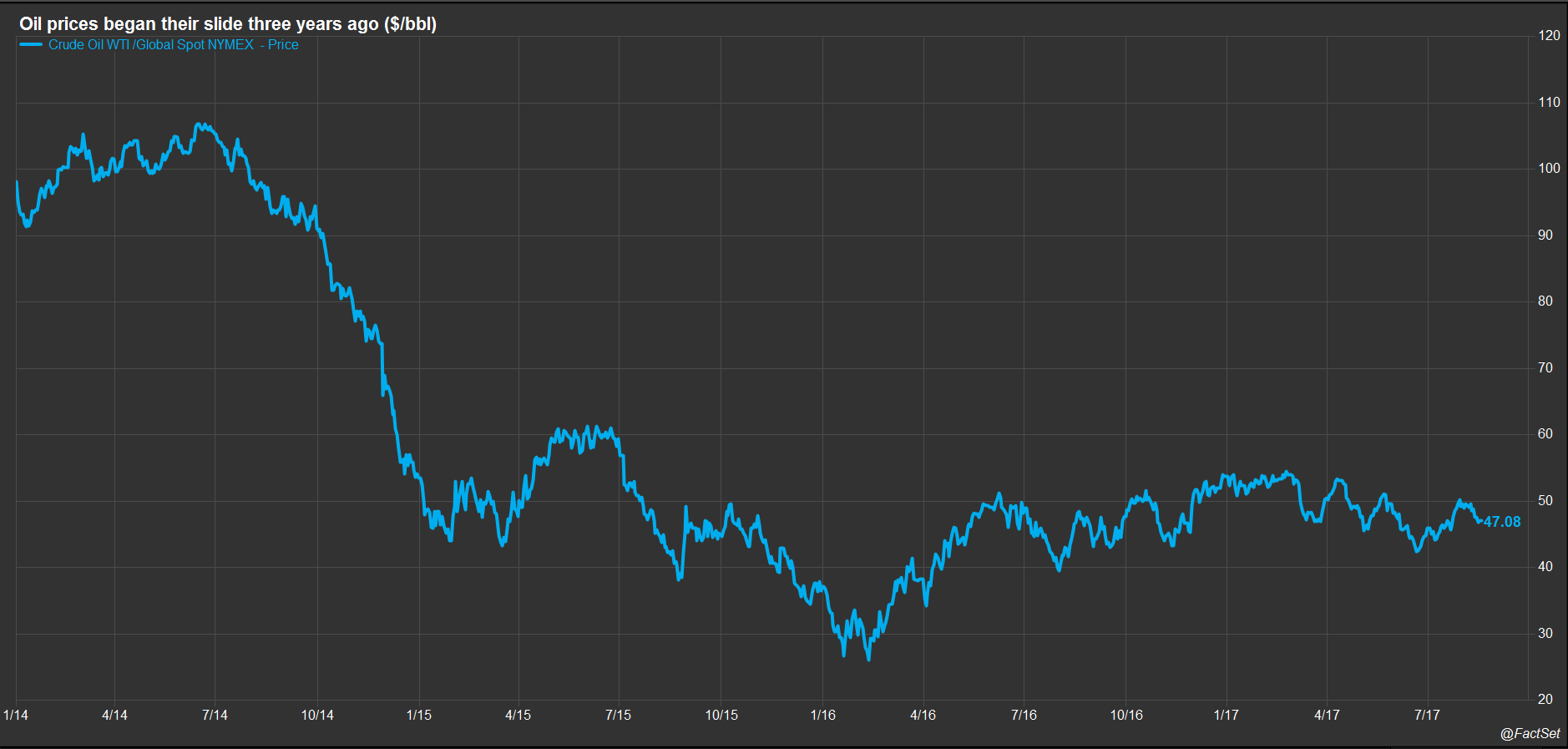

Three years ago, global oil prices began a slide that accelerated throughout the second half of 2014, heralding an extended period of lower energy prices. On August 18, 2014, the price of West Texas Intermediate (WTI) crude oil was $96.44 per barrel; by December 31 of that year, the price sank to $53.49 per bbl.

FactSet clients: launch this chart

Prices bounced around a bit in 2015, but fell even further in late 2015 and into early 2016, reaching a low of $26.14 per bbl in February 2016. Oil prices have recovered some of their losses since then and in recent weeks have been flirting with the psychological $50 per bbl threshold, with WTI closing at $47.08 per bbl on August 17. These sustained low oil prices have had varied effects across different players in the U.S. economy, with both winners and losers.

Winners from Low Oil Prices

One of the big winners from low oil prices has been the auto industry. By 2014, vehicle sales had finally recovered to pre-recession trend levels of around 17 million units (seasonally adjusted annual rate). Lower oil and gasoline prices helped give an extra boost to vehicle sales, particularly sales of less fuel-efficient trucks, including sport utility vehicles and minivans. In fact, cars sales have been on the decline since 2015 while truck sales have surged. It was the continued steady growth in truck sales that gave the auto industry a record 2016, with total vehicle sales of 17.9 million, composed of 6.9 million autos and 11 million trucks. The auto industry’s run may be over, however; so far in 2017 we have seen sharp declines from last year’s record levels, with total vehicle sales coming in at 17.1 million in July.

The American consumer was also a winner. Due to the steep drop in overall price levels, nominal consumer spending slowed dramatically in the second half of 2014, while real consumer spending growth surged, indicating that consumers were able to buy more goods and services with the money they saved on fuel. By January 2015, monthly inflation-adjusted consumer expenditures were up 4.2% from a year earlier, the fastest monthly growth rate in nearly 10 years. Real consumer spending surged by 3.6% in 2015, the highest growth rate in 11 years, contributing significantly to 2015’s 2.9% real GDP growth.

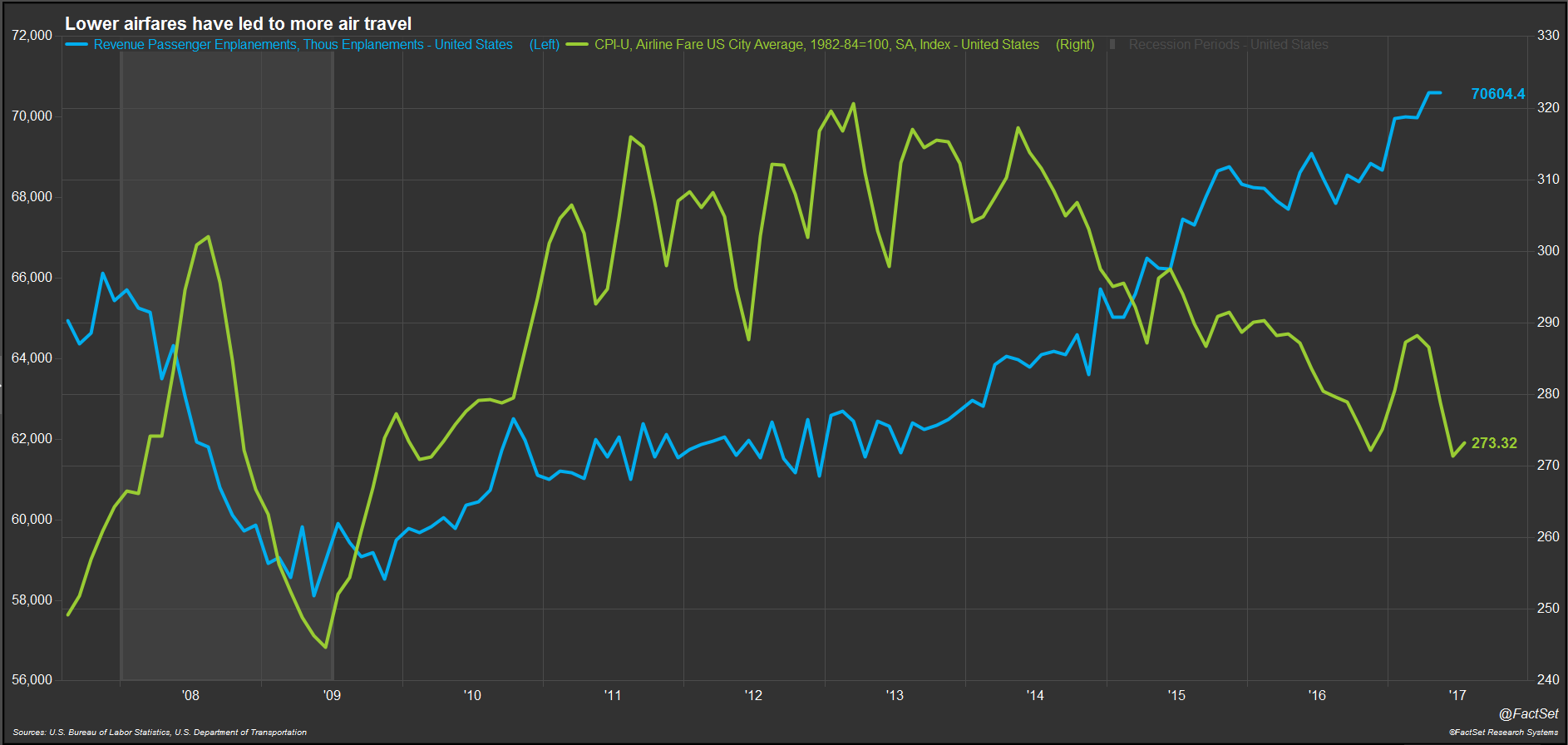

Air travelers and airlines also benefited from lower oil prices, although the gains were heavily skewed in the airlines’ favor. According to the CPI index for airline fares, fares fell by 1.7% in 2014, 5.0% in 2015, and 3.3% in 2016; cumulatively, fares are now down 13.8% from their peak in May 2014. The combination of lower fares and improved economic sentiment has pushed up demand for air travel. U.S. Department of Transportation (DoT) data shows that revenue passenger enplanements jumped 4.6% in 2015, the biggest increase since 2005. Enplanements continued to increase in 2016, reaching a new all-time high.

FactSet clients: launch this chart

The combination of higher demand and lower fuel costs led to a surge in profits for U.S. airlines in 2015, even with the fare decreases. According to DoT aggregated financial data from 25 airlines, net income for the industry nearly tripled in 2015 compared to 2014, surging from $7.4 billion to $24.8 billion, and operating profits nearly doubled. Breaking down the top line number, overall operating revenue actually fell slightly, but operating expenses fell by $13.6 billion, including a $16.5 billion decrease in fuel costs. The FactSet index of U.S. airlines saw its total return surge in the fourth quarter of 2014 and it has continued to rise in the face of continued low oil prices; total returns are up 100% since the beginning of 2014, compared to a 37% increase for all U.S. companies.

Losers from Low Oil Prices

Companies with business activities related to oil extraction have been the big losers from sustained low oil prices. Since the beginning of 2014, the FactSet industry index total return for Oilfield Services/Equipment is down 39%, Oil & Gas Production is down 45%, and Contract Drilling has plummeted by 75%. Contract drilling company Helmerich & Payne, Inc. has seen its market value fall by more than half over the last three years, dropping from a peak of $12.8 billion in July 2014 to $4.7 billion this month.

FactSet clients: launch this chart

With many players in the industry now in financial distress because of low oil prices, it is not surprising to see an uptick in M&A activity. For the U.S. Contract Drilling industry, we have seen 96 deals over the last 12 months with a transaction value of $38 billion, compared to 79 deals in the same LTM period of 2016 worth a total of $14.5 billion. Analysts surveyed by FactSet expect oil prices to remain below $60 through 2020, so we can expect to see increased M&A activity for the foreseeable future.

According to data from the U.S. Bureau of Labor Statistics, oil and gas extraction jobs peaked in October 2014 at 200,800; since then 22,800 jobs have been shed, a drop of more than 11%. Because oil reserves are concentrated in a few states, the impact on these specific states’ economies has been dramatic. The states with the largest percentages of jobs in mining and logging are Wyoming, North Dakota, and Alaska, but their shares have fallen sharply since the beginning of 2014; over the last three and a half years, Wyoming dropped from 9.1% to 7.3%, North Dakota from 6.0% to 4.3% and Alaska from 5.0% to 4.0%. Even though the national unemployment rate is now at its post-recession low at 4.3%, the jobless rates across the country vary dramatically. The three states with the highest unemployment rates in the country are all oil-producing states: Alaska (7.0%), New Mexico (6.3%), and Louisiana (5.3%).

Low Oil Prices Lead to Shifting Fortunes Ahead

Assuming a geopolitical crisis does not spark an anxiety-induced run-up of oil prices, global supply and demand dynamics seem to indicate that low oil prices are here to stay. However, the possibility of shifting fortunes cannot be underestimated. Consolidation in the contract drilling industry may lead to new cost saving opportunities or alternative technologies that would provide a competitive advantage. Additionally, consumers may see inflation surge due to non-energy commodities and services, and interest rates are likely to climb alongside the Fed’s tightening monetary policy, both of which could have a negative impact on consumer spending. As a result, today’s winners could be tomorrow’s losers and vice versa.