While all US companies report EPS on a GAAP (generally accepted accounting principles) basis, many US companies also choose to report EPS on a non-GAAP basis. There are mixed opinions in the market about the use of non-GAAP EPS. Supporters of the practice argue that it provides the market with a more accurate picture of earnings from the day-to-day operations of companies, as items that the companies deem to be one-time events or non-operating in nature are typically excluded from the non-GAAP EPS numbers. Critics of the practice argue that there is no industry-standard definition of non-GAAP EPS, and companies can take advantage of the lack of standards to (more often than not) exclude items that have a negative impact on earnings to boost non-GAAP EPS.

Related: S&P EPS Results Surprise, Sales Disappoint

GAAP vs Non-GAAP EPS Estimates

As of today, all of the companies in the Dow Jones Industrial Average (DJIA) have reported EPS for Q1 2016. What percentage of these companies reported non-GAAP EPS for Q1 2016? What was the average difference and median difference between non-GAAP EPS and GAAP EPS for companies in the DJIA for Q1 2016? How did these differences compare to last year?

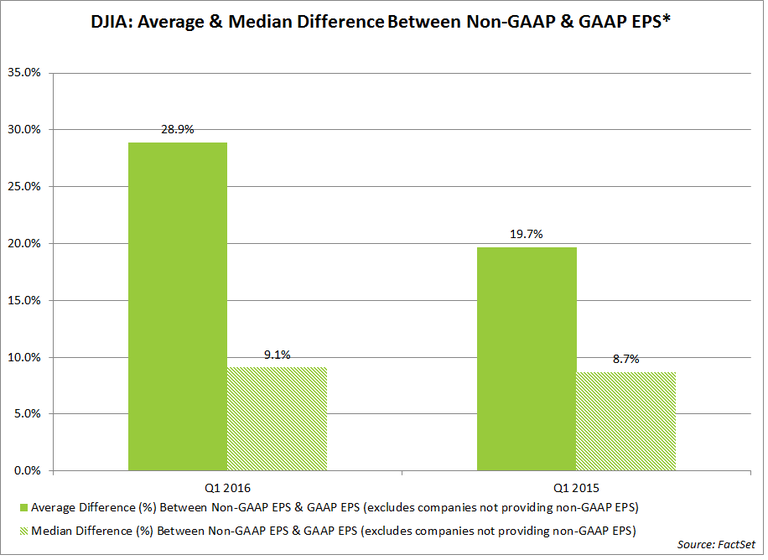

For Q1 2016, 19 of the 30 companies in the DJIA (or 63%) reported non-GAAP EPS in addition to GAAP EPS for the first quarter. The average difference between non-GAAP EPS and GAAP EPS was 28.9%, while the median difference between non-GAAP EPS and GAAP EPS was 9.1%. For 15 of these 19 companies, non-GAAP EPS was higher than GAAP EPS.

A year ago, for Q1 2015, 16 of the 30 companies in the DJIA (or 53%) reported non-GAAP EPS in addition to GAAP EPS for the quarter. The average difference between non-GAAP EPS and GAAP EPS was 19.7%, while the median difference between non-GAAP EPS and GAAP EPS was 8.7%. For 14 of these 16 companies, non-GAAP EPS was higher than GAAP EPS. Thus, there was a wider gap between non-GAAP EPS and GAAP EPS in Q1 2016 on an average basis and on a median basis compared to Q1 2015 for companies in the DJIA.

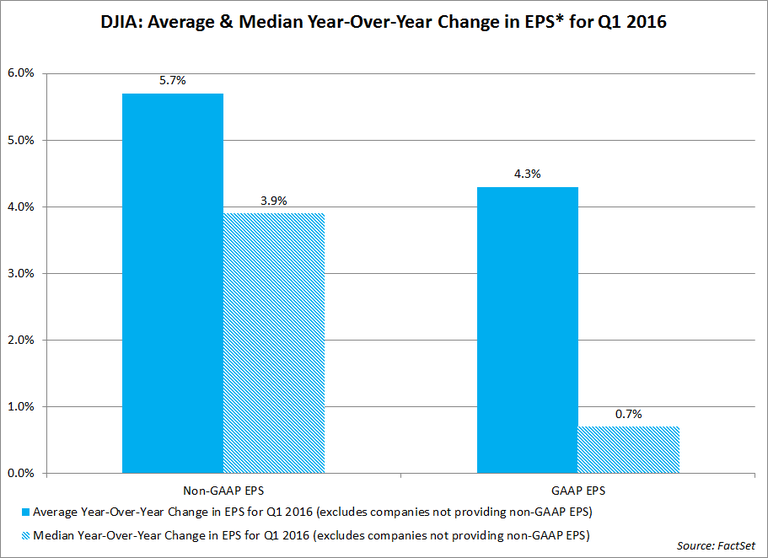

Due in part to this wider gap between non-GAAP EPS and GAAP EPS, companies in the DJIA reported higher average and median year-over-year growth in non-GAAP EPS compared to GAAP EPS for the first quarter. For the 19 companies in the DJIA that reported non-GAAP EPS for Q1 2016, the average non-GAAP EPS growth rate was 5.7%, while the median non-GAAP EPS growth rate was 3.9%. For these same 19 companies, the average GAAP EPS growth rate was 4.3%, while the median GAAP EPS growth rate was 0.7%.