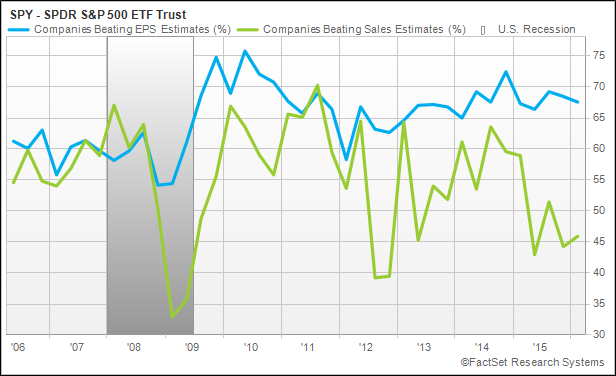

In 2016, US companies have been hurdling EPS targets with relative ease. On average, 68.5% of companies in the SPDR S&P 500 ETF (SPY) have beaten quarterly EPS estimates since 2014. In the prior eight years, however, the percentage of companies in this group averaged 65%. Even when excluding the recessionary quarters from Q1 2008 to Q2 2009, companies averaged only a slightly improved beat rate for EPS (65.8%).

Revenue expectations, however, have proven to be a harder target. Less than 46% of companies in the SPY ETF beat sales estimates in Q4 2015, with an average of 52.5% beating the Street since 2014. This compares to an average of nearly 57% over the past eight years (again excluding the recessionary periods from Q1 2008 to Q2 2009). In addition, less than half of companies in the fund beat sales estimates for three of the four quarters of 2015 (2015/2C was the exception).

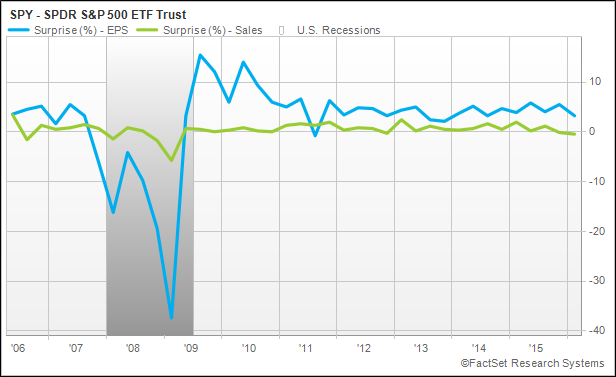

This gulf between companies reporting positive surprises for EPS and sales has widened over time. Within the past 10 years, only the unpredictable recovery year of 2009 featured such a large difference in the two metrics. Stock market comparisons to 2009 are noteworthy of course. Using daily closing prices, the SPY rebounded 68% from trough to peak in 2009, a far cry from the relatively subdued volatility of 2015 (+17% from trough to peak).

The failure of companies to beat sales estimates has also contributed to aggregate surprise figures (the sum of reported results relative to estimated ones) turning negative for the first time since Q3 2012. In fact, the third and fourth quarters of 2015 were the first two consecutive, negative sales surprise quarters since Q3/Q4 2008. Aggregate surprise figures are generally lower on the sales side relative to EPS, and have averaged a 0.5% premium to expected results over ten years. This compares to an average of 4.1% for EPS.

Margin Expansion, Not Buybacks, Supporting EPS Surprise

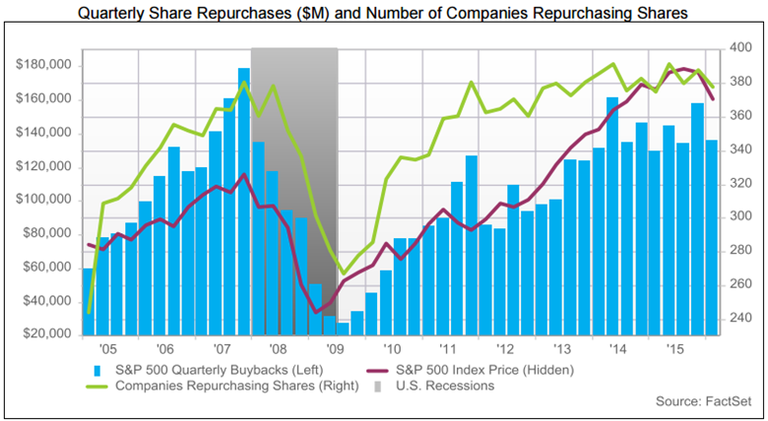

It might be tempting to explain the divergence in EPS and sales surprises on increased share buyback activity, but the hypothesis doesn’t receive much support from the data. Aggregate share repurchases and buyback participation have stabilized since 2014. In addition, companies missing sales estimates while beating EPS expectations are not more likely to have repurchased shares. One-hundred-sixty-five companies were in this group of the S&P 500 index in Q4 2015. Of those, 124 (75%) also repurchased shares in the quarter. This compares to a representation of 74% in Q4 2007, a period in which the difference in the number of companies beating EPS and sales was effectively nil.

Related: Share Repurchases Grew 5.2% Year-Over-Year in Q4

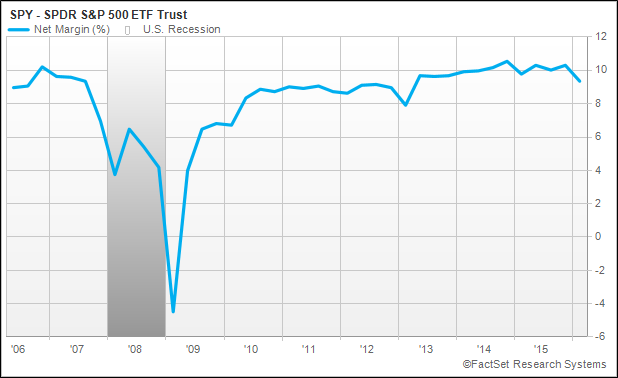

Margins, on the other hand, have shown a slow and steady march upward since the recession. Though margins dipped in Q4, analysts expect them to recover to 10.5% in the S&P 500 index over the next 12 months.

Divergence in Growth and Value Categories

The trends appear more exaggerated when splitting large cap stocks into growth and value groups. In the Guggenheim S&P 500 Pure Value ETF (RPV), less than 40% of companies beat sales estimates in both the first and fourth quarters of 2015. This compares to a 10-year average beat rate that is north of 50%. In addition, aggregate margins in Q4 2015 fell to their lowest levels (5.0%) in three years.

In the Guggenheim S&P 500 Pure Growth ETF (RPG), on the other hand, the primarily Health Care, growth-oriented Consumer Discretionary, and Information Technology focused stocks showed an average of 59% of companies beating sales estimates in the four quarters of 2015. Aggregate net margins also hit a 10-year peak of 16.8% in Q4 2014 but have lowered steadily since then.

Q1'16 EPS Results

Companies are again reporting strong EPS results versus expectations for Q1 2016. As of May 11, 71.8% of companies have beaten EPS estimates. However, the quarter is also signaling a recovery in sales results, where 55% of companies have beat estimates so far. The reversal in sales surprises could represent a blip in the longer trend, but it’s also interesting to note that value stocks are leading the recovery. The Guggenheim S&P 500 Pure Value ETF is showing a recovery in beats on the sales side (45.5%) and in net margins (5.4%). In the Guggenheim S&P 500 Pure Growth ETF, on the other hand, margins are for Q1 have fallen to the lowest levels since Q1 2014 (14.2%).