By FactSet Insight | December 15, 2016

While all years are unique, 2016 proved to be non-sequitur with a volume and ferocity so far unmatched in the 21st century. To help determine which of the year’s surprises will be its legacy, we’ve tapped our experts to provide insight on the market events that had the biggest impact.

Read on to find out what our contributors deemed the biggest surprises and most important trends in earnings, politics, active and passive investing, mergers, fixed income, regulations, and cybersecurity.

John Butters, Senior Earnings Analyst:

In terms of S&P 500 earnings growth, the Energy sector is a focus sector for the index for both 2016 and 2017. For 2016, the Energy sector is projected to be the largest detractor to earnings growth for the index. Overall, the S&P 500 is projected to report earnings growth of 0.1% for CY 2016. If the Energy sector is excluded, the earnings growth rate would improve to 3.3%.

Andrew Birstingl, Research Analyst:

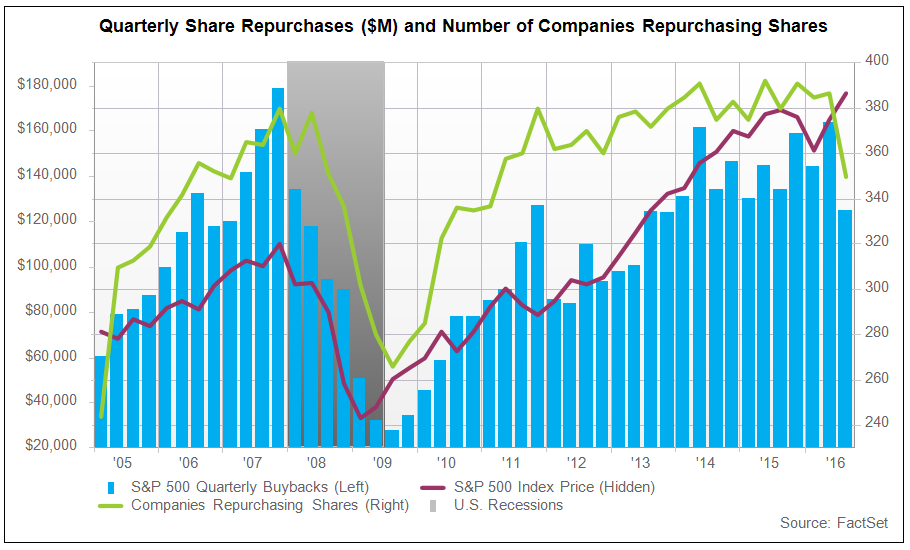

The S&P 500 (Ex-Financials) cash and short-term investments balance remained near a record high at the end of the latest quarter. S&P 500 shareholder distributions over the trailing 12 months also hovered near record levels for the index, despite the sharp decline in share buybacks during the second quarter.

share buybacks saw an up and down trend during the first two quarters, with buybacks hitting a post-recession high in Q1, then falling to its smallest total since 2013 in Q2.

Aggregate dividends for the S&P 500 also climbed to new highs in each of the first two quarters on a TTM basis.

The S&P 500 dividend yield crossed above the U.S. 10-year Treasury yield days after the start of the year. After the election, this trend has reversed with the government yield once again surpassing the dividend yield. This could make dividend stocks look less attractive especially with the Fed’s recent decision to raise interest rates.

Looking at performance, the major ETFs focusing on share buybacks (SPYB), dividends (NOBL), and capital expenditures (CAPX) have all outperformed the S&P 500 so far this year (through December 5).

Fran Reed, Regulatory Strategist:

Markets and elites underestimating the strength of spreading global populist revival was the major trend of the year.

The Brexit vote outcome was a rebuke of the establishment based on economic fears and identity crisis populism. The rural voters of the UK “shires” overwhelmingly rejected the sovereignty of “unelected” bureaucrats and policy elites in Belgium, who they felt were dictating economic and social policy to them. Similar motivations seem to be behind Trump’s Presidential victory – as evidenced by the variance outcome of electoral college vs. popular vote. Trump connected with and overwhelmingly carried the votes of the “rural county” electorate (ex-urban), in a stinging rebuke of the establishment. These shifts are likely to usher in a variety of policy and regulatory changes in the coming years.

Nikita Pillai, Senior Consultant, FactSet Canada:

Brexit was 2016’s first domino to unnerve markets, followed by Donald Trump’s election to President of the United States, and Italy’s “no” vote on the country’s referendum (which saw the resignation of Prime Minister Matteo Renzi and the creation of the 64th government in Italy’s merely 70-year-old history as a republic).

With Trump’s ascendance to the White House, one major unknown has been removed and global stocks, market optimism, and prospects for economic growth all seem to be trending up as a result. With new momentum from markets, forecasts for global economic growth look positive.

Turning to Europe, the European Central Bank’s “whatever it takes” approach impeded any significant rise in panic from markets this year, insulating the union from the various political outcomes across the region.

Overall, global markets absorbed 2016’s political shocks quite well.

Ashley Fritz, Portfolio Analysis Specialist:

This was definitely a year in which environmental, social, and governance (ESG) investing became water-cooler talk. Even though ESG investing has been around for some time, investment professionals are always looking for new and better ways to generate alpha or explain portfolio performance. With integration to databases such as MSCI, FactSet now allows users to look at their portfolios in ways that would difficult or impossible to do with other systems.

Elisabeth Kashner, Director, ETF Research, ETF Analytics:

The ETF universe is on track to have at least 100 funds more at the end of 2016 than it did at the end of 2015. ETF investors have even more choice now than they did just a year ago: 1,953 funds as of December 14, 2016. ETF assets continue to grow, standing at 2.55 trillion as of December 13, up from 2.15 trillion at the end of 2015.

The expanding ETF census doesn’t explain the asset growth. New ETF launches in 2016 have not met with much success. Of the 223 funds that launched this year, only 11 have cracked the $100 million mark. That’s only half 2015’s total.

2016 saw two dozen thematic or niche ETF launches, like Global X Millennials Thematic ETF (MILN) or 3D Printing ETF (PRNT), but none has attracted much investor interest. The largest, SPDR FactSet Innovative Technology ETF, has assets of just over $12 million. There’s been no repeat of 2015’s SPDR S&P North American Natural Resources (NANR) or iShares Exponential Technologies (XT), to say nothing of 2014’s HACK.

In 2016 fund flows, 84 ETFs funds attracted $1 billion or more, but only three of those 80 were launched after 2013. And one of those three was a spin-off of the real estate holdings from giant Financial Select Sector SPDR (XLF) – and a spin-off is not new investment. So, really, only two funds launched after 2013 gained $1 billion or more so far in 2016: Jeff Gundlach’s TOTL, and Goldman Sachs’ Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF (GSLC).

Lately, investors have been sticking to the tried-and-true. If you’re not Jeff Gundlach or Goldman Sachs, or a well-established behemoth like SPY, VOO, or AGG, your ETF has probably had a rough year in the asset-gathering arena.

Read more of Elisabeth's year-end observations in Innovation and Consolidation in ETFs

Bryan Adams, Director, FactSet M&A:

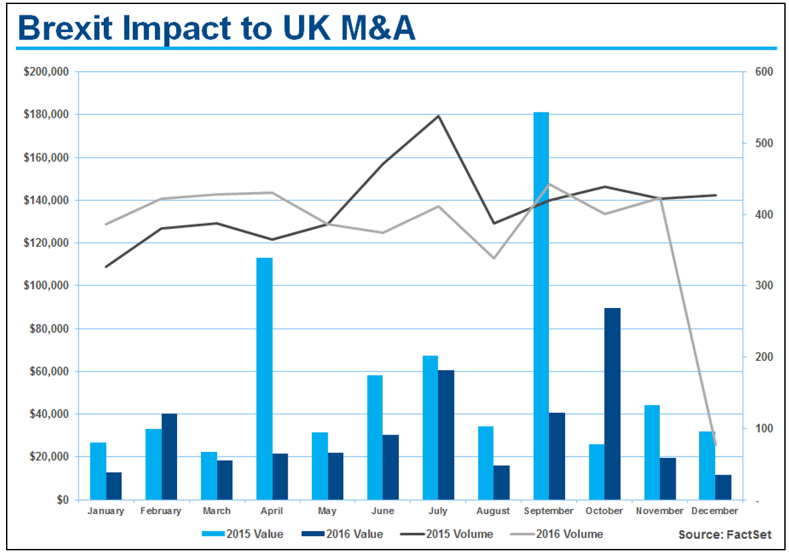

In Europe, the Brexit vote outcome was undoubtedly the big surprise, effectively putting the brakes on UK deal making for the summer and subsequently sent shivers through Europe (which is now facing its own identity crisis). The impact likely just brought forward a decline in M&A that had already begun.

Read more of Bryan’s year-end observations in 2016 Surprises, 2017 Predictions for M&A

Tom Davis, Global Head of Derivatives Research VP, Analytics Research:

For me, 2016’s big trends were swaps moving on platform around the globe, regulatory pushes for consolidation and transparency of risks inherent in OTC derivatives, and the rise of swap execution facilities and special drawing rights.

Pat Reilly, VP, Fixed Income Analytics, EMEA:

The key trend seen continuing throughout 2016 was the outsized impact of central bank policy on the valuation of risk assets – whether one looks at the U.S., eurozone, or Japan, cheap money pushed markets through an early bout of volatility and onto new highs across asset classes.

The party had to end sometime, so the biggest surprise was twofold, but related. First, Brexit in June, where the impossible became possible. Second, was Trump’s victory in November. More surprising than his win was the emergence of a reflation trade that saw bond investors endure the worst two weeks in 25 years when yields spiked 50+ bps while broad equity indices hit all-time highs. This contrasted with warnings of broad based selloffs or “risk off” trades across global markets. We just haven’t seen that before.

Anastasia Dokuchaeva, Director of Global Regulatory Solutions:

This year’s biggest surprises included the extraordinary industry discussion on what will happen to MiFID II enforcement in a post-Brexit UK. MiFID II is a huge regulation affecting many areas of finance across Europe, and access to a “single market” is one of its fundamental elements. If the UK does not comply with MiFID, it cannot be part of the market. Yet the thought behind Brexit is rejecting Luxembourg’s dictation of the rules.

After the U.S. election, we’ve seen speculation around what will happen to Dodd-Frank and Obamacare. Hillary Clinton was a big supporter of Dodd-Frank, which put a lot of heavy regulatory requirements around trading activity. By contrast, Donald Trump has been very outspoken about his “de-regulatory” intentions and his dislike of Dodd-Frank.

Back in Europe, the Market Abuse Regulation took effect in July 2016 and snuck up on many. Everyone was so preoccupied and concerned with MiFID II, they all thought MAR would be small and simple. Yet when it actually went into effect, everyone suddenly realized how much they have to do to be compliant and went scrambling for solutions only to find out that there wasn’t really one on the market.

Solvency II, which took effect January 2016, also gave companies lots of headaches throughout the year.

Bill McCoy, Vice President, Senior Product Manager, Fixed Income Research:

Despite avowals from all past presidents (George Washington excluded) to reduce government involvement and regulation, government hiring has steadily increased. Regulation can be a good thing. But regulation, no matter how well intentioned, can cause serious side effects. The Volker Rule has had a deleterious impact on the liquidity in the bond market, which in turn should widen bond spreads when the next crisis hits

Read more of Bill’s year-end observations in The "Obvious" Fixed Income Forecast for 2017

Fran Reed, Regulatory Strategist:

Some of the biggest surprises in 2016 related specifically to how information is created, protected, and distributed in a connected society.

Cybersecurity issues moved beyond bank and credit card theft and onto to the political stage with allegations of classified data and elections tampering/influencing. People may have previously assumed everything they do online is monitored and recorded, by U.S. intelligence agencies and other domestic entities, but now foreign regimes appear to be just as involved as well.

Misinformation was also a major theme for the year. More than any time in history, 2016 was punctuated by the rise and wide-spread abuse of the internet as a delivery mechanism for false or misleading news stories, often promoting a particular ideology or agenda. With an information hungry populous often playing the part of unwitting transmission vector (via re-tweet), fake news items that spread can have real-world outcomes with sometimes deadly serious consequences. This is problematic not only for individuals or political movements, but potentially for markets as well.

How Private Capital Is Powering the Johor-Singapore Special Economic Zone

This FactSet analysis provides insight into the early stage of the JS-SEZ progress with key data points. Stay informed on how...

How Transaction Cost Analysis Is Evolving from Compliance Tool to Trading Decision Support

Discover insights to further strengthen your TCA capabilities in this FactSet analysis. Consider how you can make the most of TCA...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.