By FactSet Insight | December 31, 2019

As the curtain falls on 2019, our experts offer their predictions for the trends that will shape 2020.

Sara Potter, Vice President, Associate Director, Thought Leadership and Insights

While falling industrial production and a contracting manufacturing sector indicate an industrial recession, the consumer remains confident and consumer spending continues to buy economic growth. This is perhaps not surprising given that unemployment is at 50-year low and inflation subdued. It remains to be seen whether the slowdown in manufacturing and agriculture eventually hurts the consumer.

While the odds of a near-term recession appear to have diminished, growth is projected to slow in the coming quarters due to a weaker global outlook and reduced global trade flows. U.S. economic growth is expected to continue to slow into 2020, with analysts surveyed by FactSet projecting 2.3% annual growth in 2019 followed by 1.8% in 2020.

Insight/2019/12.2019/12.31.2019_2020%20predictions/US%20annual%20GDP%20forecasts.png)

Sara Potter, Vice President, Associate Director, Thought Leadership and Insights

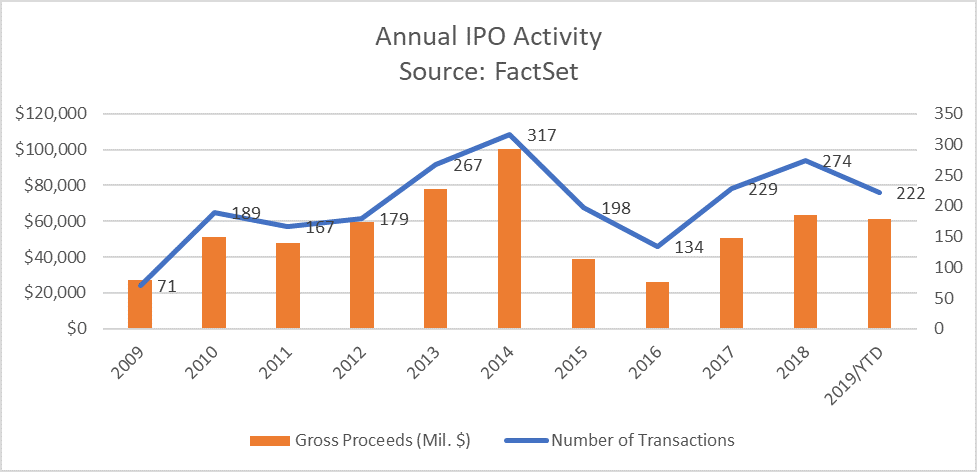

With the U.S. stock market currently trading at or near record highs, the stage is set for a pickup in IPO activity in the coming months. There are 63 private companies that have released initial preliminary filings this year and are still in registration (this excludes offerings that have been postponed or withdrawn). 22 of them have filed so far in Q4, indicating a decent pipeline for early 2020. However, the days of the mega tech IPOs may be behind us. Investors have grown increasingly wary of lofty valuations; companies will need to prove that they are well-run, have growing revenues, and will eventually turn a profit. At the same time, global market uncertainty due to Brexit and ongoing trade tensions have the potential to squash the IPO market.

John Butters, Vice President, Senior Earnings Analyst

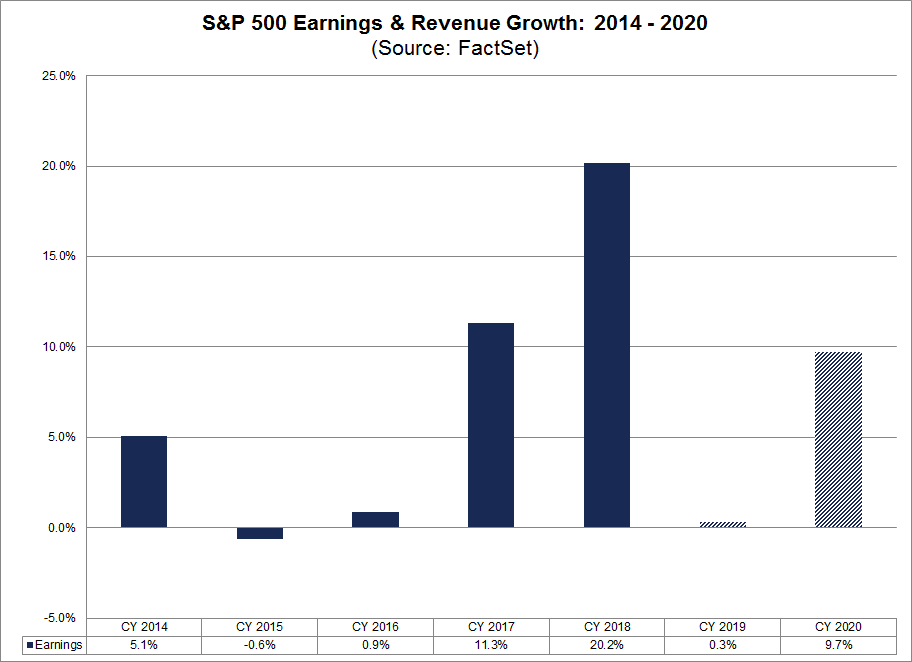

The estimated (year-over-year) earnings growth rate for the S&P 500 for CY 2020 is 9.7%, which is above the 10-year average (annual) earnings growth rate of 9.1%. All eleven sectors are projected to report year-over-year growth in earnings, led by the Energy, Industrials, and Materials sectors. S&P 500 companies with more international revenue exposure are expected to report higher earnings in CY 2020 relative to S&P 500 companies with less international revenue exposure.

Elisabeth Kashner, CFA, Vice President, Director ETF Research

I predicted increasing vertical integration because of the 2018 and 2019 trends around banks and brokerage firms getting more aggressive with cross-selling their own ETFs. The Schwab/TD Ameritrade merger will allow Schwab access to a larger customer base, to which they can offer complete financial management with planning, portfolio management (portfolios full of Schwab ETFs), banking, and brokerage. In a vertically integrated environment, due diligence matters more than ever because clients have to be aware of the principal/agent problem and must independently verify in-house recommendations.

John Adam, Senior Vice President, Trading Solutions

I think that 2020 is the year we will see automation and data science enter the mainstream as foundational components of the portfolio lifecycle. Specifically, we will see a marked uptick in multi-asset trade automation.

Electronic liquidity is proliferating across multiple asset classes where it has previously been scarce. And the tools for automation and data science are more accessible to traders and portfolio managers than ever before. What was once exotic and had to be created from a blank slate are now fully matured features in the Execution Management System.

Most exciting of all, the trader can rely on automation and data science to scale their productivity and assure consistent best execution for low-touch and no-touch trading. All of the pieces of the puzzle are now ready for prime-time. And I look forward to seeing how the buy-side trading desk continues to evolve and grow.

Pat Reilly, Vice President, Fixed Income Analytics, EMEA

On the back of my 2019 Biggest Surprise, I have four predictions for the fixed income landscape in 2020:

Regulatory: The Slow Death of Post-Crisis Regulation Has Been Exaggerated

Barrie Ingman, Regulatory Advisor

In 2020, MiFID II will be changed: it’s official. Expect more bewildering tweaks to the transparency regime and further developments in relation to a real-time (!) equity consolidated tape, among other measures. Post-Brexit, there could even be some MiFID II roll-back following industry pressure on German politicians, just as Germany prepares to take over the EU Council Presidency.

Equally, Brexit will happen. That is also official. It is also what we said last year. However, this time we mean it! Notwithstanding such brave predictions, whether it’s a Hard-Brexit, a modest Brexit, or some form of a candied, fudged Brexit-transition is anyone’s guess. We predict the unpredictable…including predictably unpredictable Brexit-driven GBP volatility. Nevertheless, one area of convergence across the English Channel is "operational resilience," which is a key theme in 2020 for both EU and UK policy drivers.

In other matters, AMLD 5 will go live at the beginning of the year and AMLD 6 will go live at the end of the year. Moreover, those initiatives that began to bud last year, will start to unfurl; especially the banking prudential reforms and ESG developments as Germany—undergoing a green political revolution—takes over the EU Presidency. Expect in particular, taxonomy developments and new rules around "short-termism."

As with the EU, the SEC will seek to tackle the intractable problem of equity market structure, with both continents focusing on market data and the latter focusing in particular on REG NMS reforms. EU fund managers will be subject to greater stress testing obligations and scrutiny, the frenzied anxiety around LIBOR transitioning will intensify, and the perennial billion-dollar fine for AML failings is likely to be meted out at some stage if the previous 10-year pattern of financial crime enforcement persists. Attempts to govern blockchain, crypto-assets, and other tech phenomena will also continue to grab column inches. In summary, a new year but the same old story: an overwhelming, unabated, torrent of regulation. Some of which is predictable, some less so.

Philipp Zerhusen, Vice President, Director of Market Development

While the EU legislation with a standardized framework (expected to be effective by January) is delayed over some debates such as whether Nuclear Power should be considered as climate friendly, ESG and “thematic investment” will be a key focus for Wealth Management in 2020. Private investors—not only since Greta Thunberg—are increasingly concerned about where and how their funds are invested and no longer on returns only. Advances in AI allow machine-assisted discovery of “themes” and linking those themes to investment opportunities. It also cements my view that fully discretionary advisory models will disappear over time as investors are a) better informed than ever and b) want to have their individual beliefs and preferences reflected in their investments. We are on the verge of highly individualized investment plans, not only for the upper end of (ultra) high net worth individuals but increasingly for the mass affluent and high-street investor as well.

Peter Davaney-Graham, CFA, Vice President, Head of Open:FactSet Content Strategy

I expect to see continued acceleration of data-driven decision-making being adopted across the investment community. We’ve already seen data science, machine learning, AI, and alternative data concepts growing in popularity at all of our clients and I expect to see traditional fundamental managers, private equity companies, sell-side research, and even wealth managers further embrace these concepts over the next year. I expect that data science techniques will become a core competency requirement across the financial landscape and that the early adopters will be able to build a strong moat compared to the firms slower to invest in these areas.

U.S. Mergers & Acquisitions Monthly Review: June 2025

Explore FactSet's U.S. Mergers & Acquisitions Monthly Review. Gain deep insights into market trends and expert analysis to inform...

Metals & Mining: Looking for a Safe-Haven Asset?

Compare gold vs Bitcoin as safe-haven assets. Explore which performs better as a store of value during economic and geopolitical...

U.S. ETF Monthly Summary: June 2025 Results

Get the latest monthly U.S. ETF flow results in this FactSet analysis. Learn flows by asset class and sector, ETF launches, and...

U.S. Mergers & Acquisitions Monthly Review: May 2025

Explore FactSet's U.S. Mergers & Acquisitions Monthly Review. Gain deep insights into market trends and expert analysis to inform...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.