In the aftermath of the 2008 financial crisis, scarred by huge portfolio losses, investors increasingly demanded investment vehicles that could offer protection in falling, volatile markets. At the same time, numerous academic studies were published on the so-called “low volatility anomaly”; contrary to finance theory, over the long term, stocks with lower price volatility have out-performed stocks with high price volatility. As an outgrowth of the 2008 financial crisis, this anomaly was “rediscovered” and “productized.” Since then, a number of “low vol” products have flooded the industry and raised several billion dollars in assets; investors have embraced the concept and low equity volatility is now a new asset class.

Reflecting the academic research, the existing low volatility strategies available today are mainly driven by statistical volatility – the standard deviation of stock price change over a defined period. But, what’s the actual merit of these strategies? Is it sound to invest money in strategies that in essence select stocks based merely on their past price fluctuations? What goal is an investor trying to achieve with these strategies?

If the goal is to maximize long-term cumulative growth through downside protection, we believe a fundamentally-driven, low-volatility strategy offers greater potential.

Current Types of Low Volatility Strategies

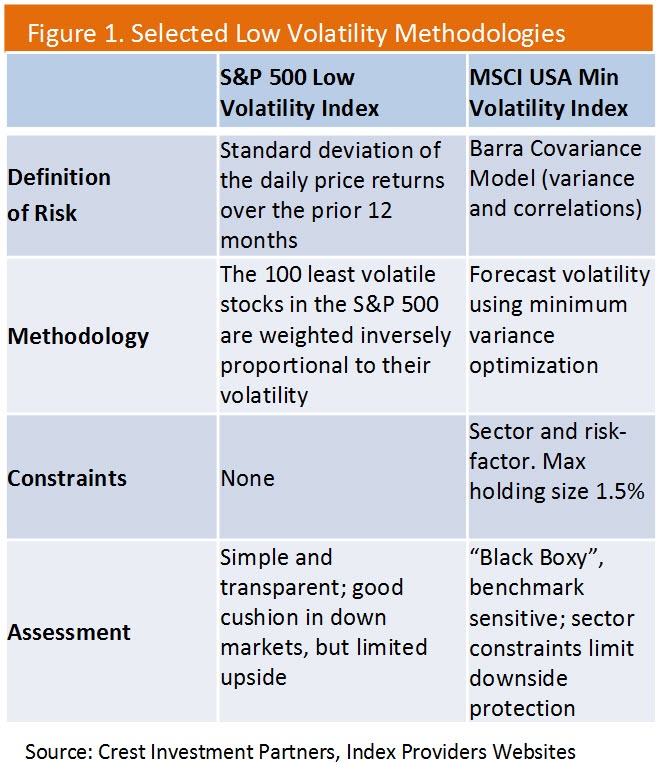

Current low volatility strategies follow one of two methodologies: minimum variance optimization strategy or non-optimized low volatility strategy. Figure 1 describes two representative low volatility index methodologies, the S&P Low Volatility Index and the MSCI Minimum Volatility Index.

In optimized models, it is assumed that stocks have the same expected return and volatility and correlations are estimated using a risk model. These indexes lack transparency and, in an attempt to reduce tracking error, have significant exposures to non-defensive sectors. Consequently, they do not provide strong downside protection – which is a major reason why an investor would invest in a low volatility strategy in the first place. Non-optimized models simply sort stocks on their past price volatility and select the least volatile ones. Each stock in the index is then weighted by the inverse of its volatility, so that the stocks with lower volatility receive the higher weights. These indexes are transparent and provide good downside protection, but they tend to be very concentrated in the utilities sector and lack participation in up markets.

Both methodologies are mainly driven by volatility of stock prices and do not target or maximize returns. These statistical low volatility strategies lag in a rising market typically associated with economic rebounds and expansions. This lack of upside participation may impair the investor’s portfolio growth over the long run.

At the end of the day, the real risk for an investor is not the short-term stock price fluctuations, but the inability to preserve and grow wealth over the investment horizon. This requires a strategy that provides downside protection without renouncing to long term growth.

Fundamental Risk vs. Statistical Risk

From a portfolio manager’s standpoint, stock price volatility is a manifestation of fundamental risk. In turn, fundamental risk has two main components: macro and company-specific risk.

Macro Risk

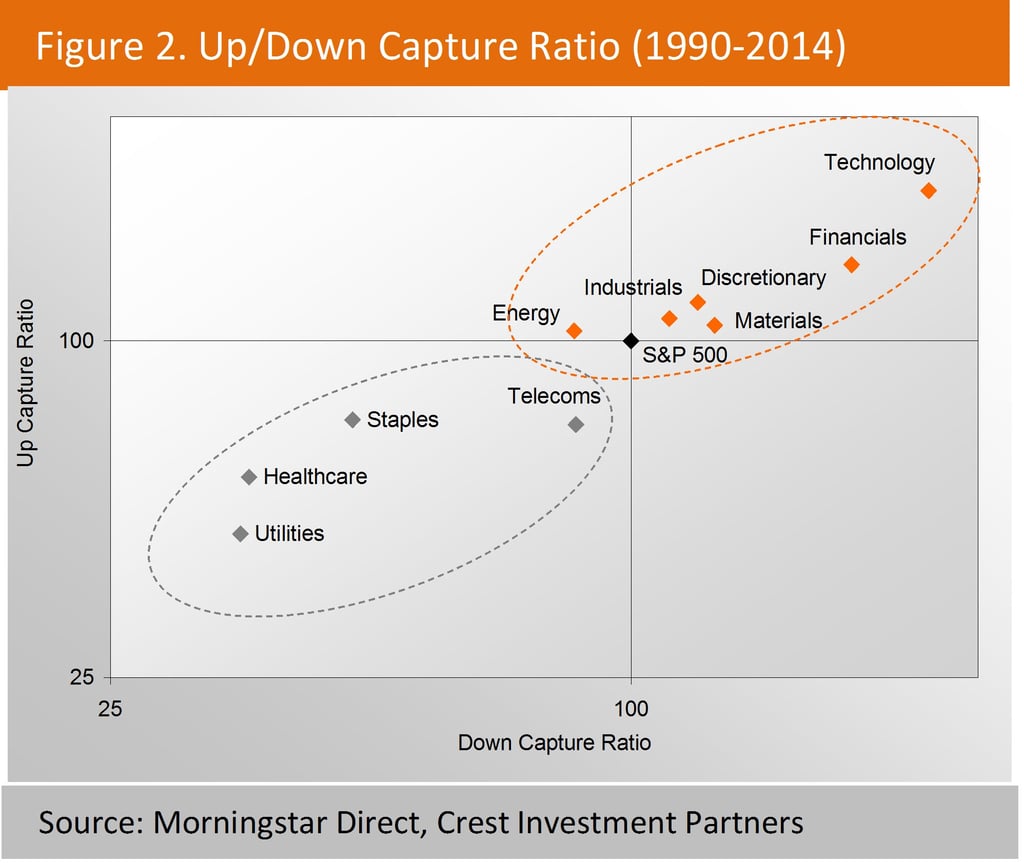

Macro risk affects all stocks and is related to the overall economy and the business cycle. The largest non-company specific determinant of equity volatility and returns is the sector in which a company operates. This makes intuitive sense as stocks belonging to the same economic sector will tend to be affected by the same economic, regulatory and technology forces. In addition, some sectors have similar sensitivity to the economic environment. For example, consumer staples and health care firms—two defensive sectors— are less dependent on the rate of economic growth than cyclical sectors such as industrials and consumer cyclicals. In fact, during corporate earnings contractions non-cyclical, defensive sectors tend to outperform. As a result, defensive sectors display consistently lower volatility and offer cushion during down markets.

It turns out that available low volatility products can be deconstructed as unintentional defensive sector strategies as their sector composition is dominated by utilities, staples and health care sectors.

Supported by empirical evidence, we advocate an approach that selects stocks exclusively from defensive sectors as a more deliberate and economically sensible way to build a defensive strategy more resilient to economic recessions and less exposed to downside volatility.

Company-specific Risk

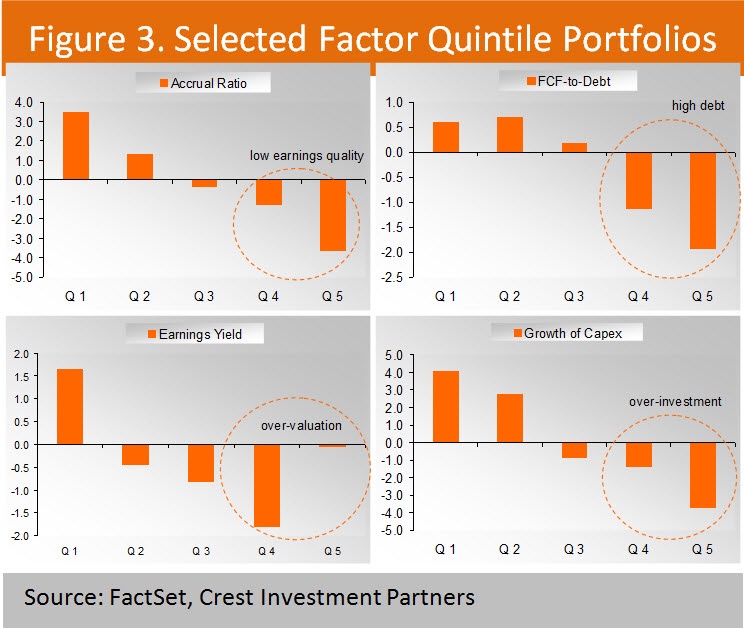

This risk is inherent to individual stocks and has three components: a) earnings persistence: a decline in earnings power reduces the equity value; b) distress: high debt leverage constrains growth and may result in bankruptcy; c) valuation: stocks trading at high multiples are riskier and tend to underperform. Indeed, empirical evidence shows that stocks with specific fundamental attributes such as low earnings quality, high debt leverage, and high valuation multiples historically have significantly underperformed the market averages. Figure 3 shows the excess returns of selected factor portfolios versus the universe average over the 1990-2014 period. For example, the stocks in the bottom quintile (quintile 5) by accrual ratio underperformed the market average by over 300 basis points per year over the period under study. Conversely, stocks in the top quintile (quintile 1) outperformed by over 300 basis points. A similar return pattern is observed for the other three factors: Companies with high (low) debt-to-cash flow, high (low) reinvestment rates and low (high) earnings yield, under (out)-performed significantly over the same period.

Conclusion

Currently available low volatility strategies and indexes are mainly driven by past volatility of stock prices and do not target or maximize returns. As a result, these statistical low volatility strategies don’t keep up with rising markets typically associated with economic rebounds and expansions. This lack of upside participation impairs their ability to maximize return potential.

Our approach is to select only non-cyclical stocks reflecting the historically consistent resiliency of defensive sectors during market downturns and economic recessions. Layering on this economic sector focus; our stock selection is based on refined fundamental and valuation factors that have demonstrated consistent excess returns over different market regimes and economic cycles. This approach delivers on both goals of mitigating downside risk and maximizing returns.