On October 8, 2015, California Governor Jerry Brown signed Senate Bill 185 into law by requiring the state’s two public pension funds, CalPERS and CalSTRS, to divest their investments in coal companies that derived at least 50% of their revenues from thermal coal. CalPERS is the nation’s largest pension fund, managing close to $300 billion in assets, and the signing of this bill could indicate a trend wherein pension funds look to better align their investment policies with the overall social movement toward reducing carbon emissions. In June, Norway’s parliament also endorsed the divestment of coal companies from its $900 billion sovereign wealth fund (SWF) – the world’s largest SWF by assets. Simply put, investors need to be aware of companies with exposure to the coal business. The challenge lies in identifying these companies.

Conventional industry classification systems can be been used to identify coal-exposed companies, but they’re limited both in scope and depth. For example, companies that receive less than 50% of their revenues from coal will not be captured; moreover, companies are not differentiated into more granular levels, such as thermal or metallurgical coal. But using FactSet Revere Industry and Sector Classifications, we can address both of these shortcomings by using highly specific industry categories and granularity to map companies on a multi-dimensional level, including their primary and ancillary businesses.

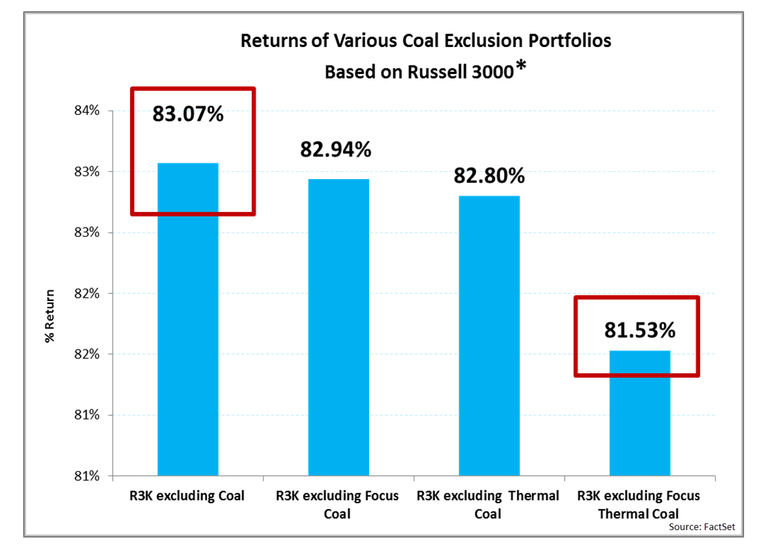

Using FactSet Revere, we applied several coal exclusionary filters to backtest the performance impact on the Russell 3000 for the past five years. The below results are based on returns from October 15, 2010 through October 15, 2015. Returns are based on total returns, including dividends reinvested.

Shown above are the results for four exclusionary portfolios: In these portfolios, we excluded:

- All coal-exposed companies in the Russell 3000 (“R3K excluding Coal”) regardless of the percentage of revenues they received from coal

- Coal-focused companies that received 50% or more of their revenues from coal

- All thermal coal-exposed companies

- Only "focus" coal companies that received 50% or more of their revenues from thermal coal

The backtested results suggested that excluding all coal-exposed companies in the Russell 3000 for the past five years yielded the best cumulative return at 83.07%, followed by excluding only coal companies that received 50% or more of their revenues from coal. The lowest return came from the portfolio that excluded coal companies that received 50% or more of their revenues from thermal coal.

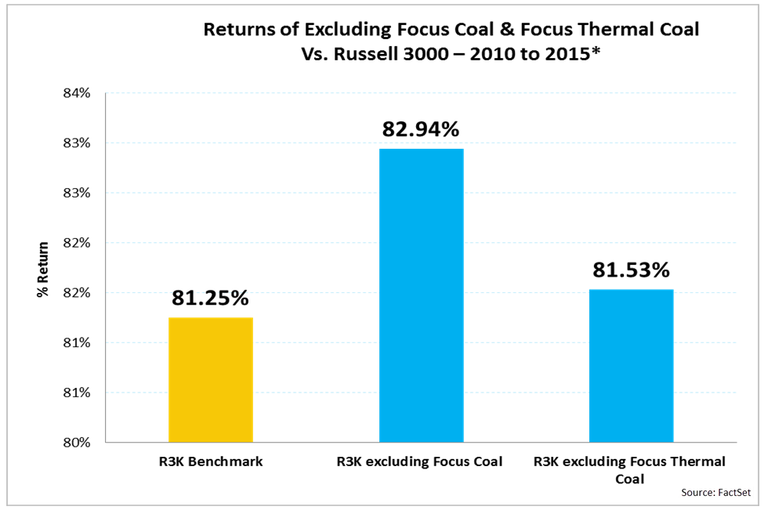

In addition, all four exclusionary portfolios outperformed the Russell 3000 (equal-weighted and rebalanced annually) in the past five years.

Excluding coal companies in the Russell 3000 for the past five years appeared to be performance enhancing, even when a more restrictive thermal coal exclusionary filter was applied.