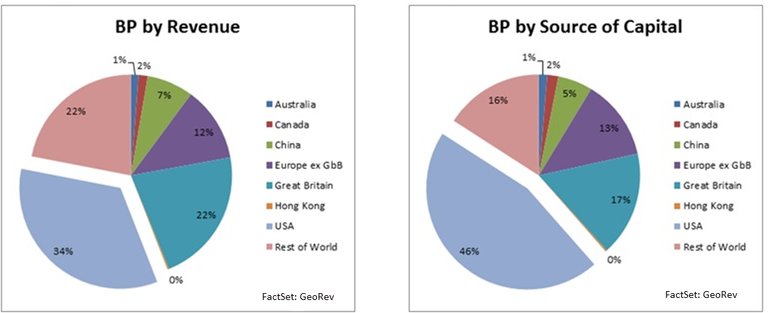

In today’s low-rate environment, corporate debt issuance has ballooned, with over $1.5 trillion in U.S. Corporate bonds in 2014 alone. But focusing solely on revenue ignores a major source of financing:debt. Analyzing Source of Capital based on geographic exposure creates a new understanding of both market and liquidity risk. British Petroleum (BP), for example, shows 34% exposure to the U.S., but accounting for its U.S. dollar denominated debt results in a 12% increase in that exposure. This is a material increase in sensitivity to U.S. market forces.

By incorporating Sources of Capital in a portfolio context, we can pinpoint the subset of a portfolio facing liquidity risk or unfavorable refinancing terms. In a sample universe of Emerging Market debt maturing in the next year, 99% of Russian debt coming due is denominated in USD, yet 83% of the revenue is from Europe.

The Ruble has crashed, and oil prices remain depressed. Couple this with a potential rate hike in the U.S., and these companies are faced with the prospect of refinancing in an adverse rate environment and in a markedly more expensive currency.

Factor in declining revenues, and we now have identified a list of companies with potential liquidity risk. One of those is Novatek OAO, Russia’s second largest natural gas producer. This past fiscal year, Novatek suffered a 66% decrease in earnings, due mainly to a mismatch between its functional currency (RUB) and its U.S. dollar denominated debt. Compared to other Russian Oil and Gas companies, Novatek is heavily concentrated in its domestic market (64% of revenue derived from Russia vs 36% average for its peer group), which means it also doesn’t benefit from more competitive exports. This is mainly due to Russian law, which requires produced natural gas volumes to be sold within the Russian Federation. To combat this exposure, Novatek began a liquefied natural gas project in the Yamal Peninsula (Yamal LNG), which when completed will allow the company to export more product into the international market. According to Novatek, “the effects of the foreign currency movements relative to our U.S.-denominated debt portfolio will be mitigated by the fact that sales of our products. . .delivered to international markets will be denominated in U.S. dollars and other foreign currencies”(Source: FactSet Filings). Assuming no delays, this plant will go operative in 2017. Until that time, over 25% of Novatek’s U.S. dollar denominated debt will mature.

The opinion on Novatek’s liquidity and creditworthiness is likely dependent on the outlook of the Oil and Gas industry, as well as the growth prospects of the Russian economy. However, a Sources of Capital approach clearly demonstrates the relationship between macro events and security cash flows. On a portfolio level, this allows us to identify true sensitivities to global market forces and better align our security selection with capital market assumptions.