By Louis Scott | July 8, 2015

As the odds shift towards an exit from the Euro for Greece, what are the risks of risks spreading across the Eurozone, and how might that affect your portfolios?

To explore this, we used FactSet's Multi-Asset Class (MAC) risk model to look at sovereign yields. This model captures the cross sectional differences among country balance sheets and, more subtly, equity and corporate effects.

Greece is not about Greece, but contagion.

In a recent Insight article, we noted that the risks to Greece are widely recognized. Greece's credit rating from S&P is CCC-; the risks are largely priced in. The same article further provided credit ratings of the remaining GIIPS countries, which show much higher quality: A+ for Ireland, BBB for Spain, and BBB- for Italy.

A second Insight feature made the case that concerns over Greece are overstated. On the basis of geographic revenues, the MSCI Europe equity index to Greece has only 30 basis points of revenues tied to Greece. If Greek debt is fairly priced, and the bond markets are not meaningfully exposed, then what is this really about?

It's about contagion and the mania of markets.

Commentators are pointing to a hardening of European negotiators to make the Moral Hazard of non-payment clear. Their reasoning is that the pain associated with default deters other indebted Europeans from seeking debt relief. The larger countries need to avoid a scenario where there are concerns with the full faith and credit of the Eurozone.

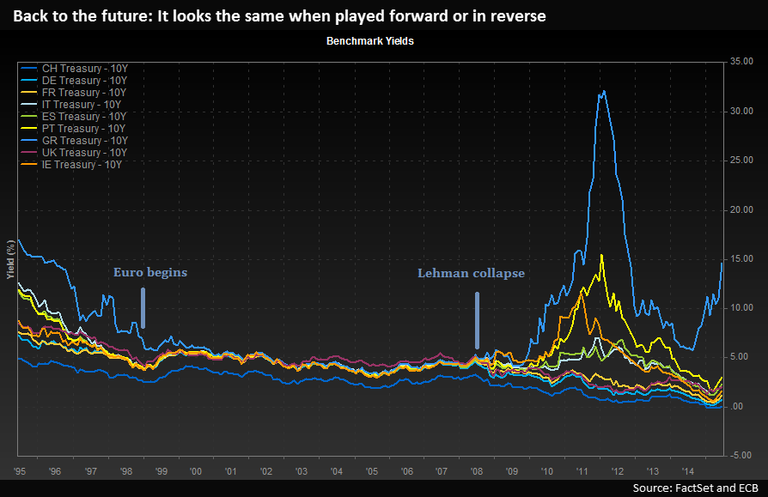

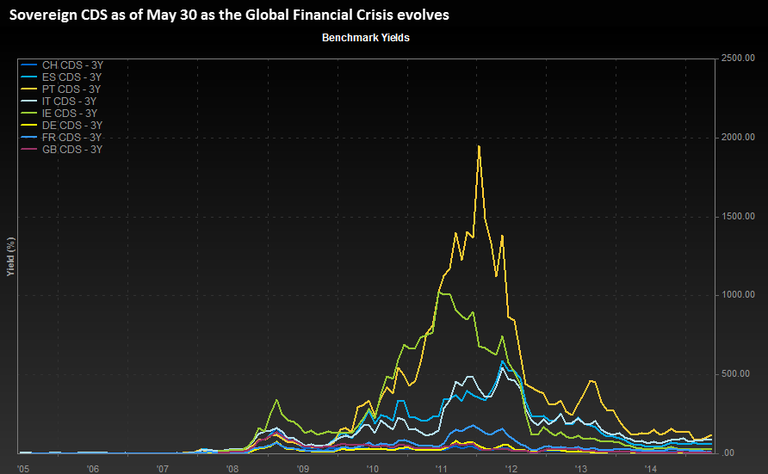

History allows for some guidance as the Eurozone suffered a crisis of confidence in 2010. In Measuring sovereign contagion in Europe2012, Caporin, Pelizzon, Ravazzolo, and Rigobon (CPRR2012) examine if the Euro sovereign crisis was an example of an extraordinary contagion event. They define contagion as the propagation of a shock that is demonstrably different for large negative shocks. The paper finds that the transmission linkages seen under small shocks and large shocks are stable. In practical terms, even under the stress of the GFC, a model that takes the data available in normal periods was useful in modeling more volatile periods.

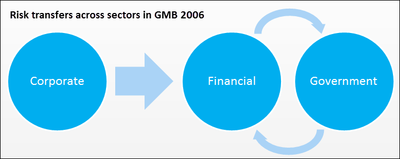

Gray, Merton, and Bodie, in A New Framework for Analyzing and Managing Macrofinancial Risks of an Economy, (GMB 2006) analyze country macro risks from a contingent claims perspective. The sectors of an economy are viewed as interconnected portfolios of assets, liabilities, and guarantees that can be analyzed as options. It allows for seeing how risks are transferred across sectors, how they accumulate on the public sector balance sheet, and how they may result in sovereign default.

GMB 2006 take the implied guarantee of the banking sector by governments as a put option and an asset of the bank's balance sheet. Shocks that affect the corporate sector feed into the financial sector which could transmit the risk to the government. Financial guarantees act as a feedback mechanism between the financial sector's and the government's balance sheets. The system's stability depends on the government's guarantee to banks. Their transmissions can be dampened or magnified depending on capital structure and linkages.

As the value of corporate assets decline, so does the value of debt and equity which leads to a decline in bank assets and an increase in the implied guarantee. Negative shocks to the government's financial position impacts the banks since they hold large amounts of government debt.

Giroud and Mueller, in Firm Leverage and Unemployment During the Great Recession (GM2015), add agreement to the mechanisms in GMB 2006. They look at firm level data and find that almost all of the job losses associated with falling housing prices during the Great Recession are in highly levered firms. At a county-level aggregate, leverage was tied to declines in employment due to household demand shocks.

Jimenez, Ongena, Peydro, and Salas, in Credit Demand Forever? On the Strengths of Bank and Firm Balance-Sheet Channels in Good and Crisis Times (JOPS2014), examine the transmission between banks and firms using a dataset of loan applications and firm balance sheet data in Spain from 2002 to 2010. They find firm level heterogeneity in leverage was a strong determinate in loan grants in both good and bad times.

Given the linkages established in the above papers, we next focus on contagion to the other southern Europeans.

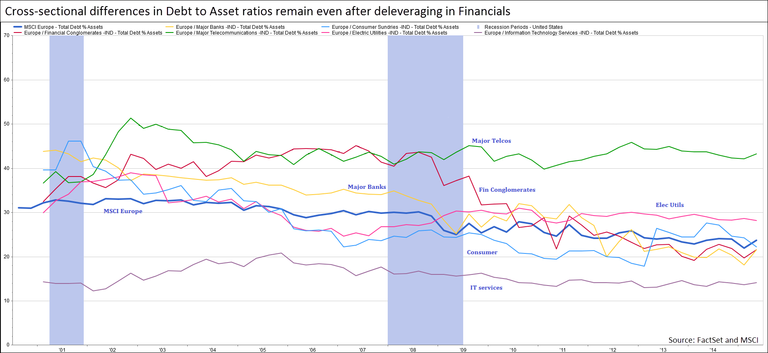

For equities and corporates the cross sectional differences in country sector aggregation of firm leverage should matter.

Highly leveraged firms will:

To illustrate this, shock the five-year Spanish sovereigns. The stronger linkages among the major European countries should translate to a transmission of shocks. Recall that (CPRR2015) reviews and support the stability of shock transmissions within the Euro countries.

For equities, the highly leveraged firms benefited the most from the convergence of yields during the period of Euro formation. The premise here is that this plays out in reverse: focus on the effect of sovereign credit spreads onto both corporate bonds and their equity as a cross-sectional effect across countries and firm-level differences in leverage. It is back to the future – circa 1998.

Finally, one could simply shock the stock market. Consistent with Driessen 2005, Is Default Event Risk Priced in Corporate Bonds, who argues that a large part of the premium is due to systemic risk of firms defaulting in waves. For a review, see our recent Insight piece on the credit spread puzzle.

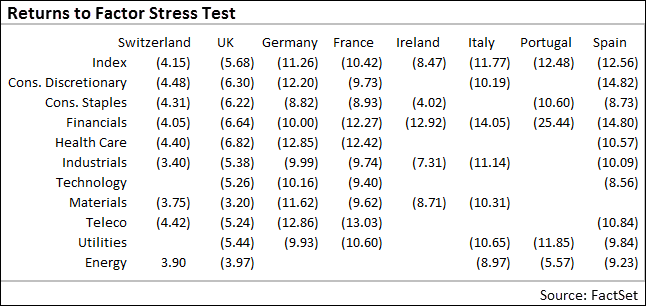

If Spanish five-year bonds were to experience an increase of 100 basis points, what would that do European equities? The MAC model factor stress test indicates that across the major Eurozone countries, the effect is relatively uniform: a drop of 11 to 12 percent as shown below.

Here, we shock the Spanish five-year bond up 100 basis points and look at the returns due to this shock for the MSCI country indices. Switzerland and the UK provide relative safety. Italy, Spain, and Portugal perform mildly worse at the country level. The financial sector performance is in line with Debt to Asset levels.

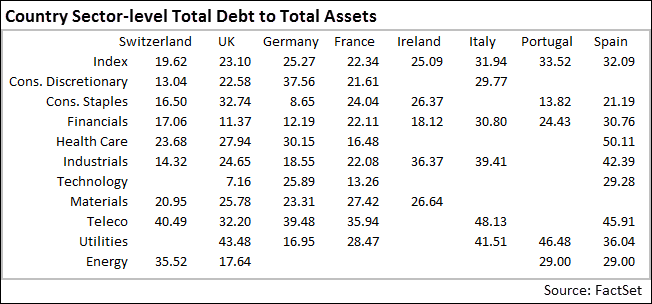

Looking at differences across countries, the results are in line with country level balance sheet quality as proxied by Total Debt to Total Assets shown in the next figure. The effect dominates sector-level differences, with the exception of financials where the higher exposure translates into subpar stress results for Italy, Portugal, and Spain.

The countries on the left have better aggregate equity debt to total assets ratios, our broad measure of balance sheet quality. The exposure for the southern European countries is in agreement with the cross country stress tests results. Relative to Switzerland, Total Debt to Total Assets for Italy, Spain, and Portugal are 1.6 to 1.7 times higher.

The time series of sector-level debt to assets have fallen since the crises. Firms are in a better position to weather macro risks. Governments, on the other hand, are more highly levered and therefore reliant on maintaining faith in Eurozone commitments to keep debt costs down. Here, we have attempted to motivate both the linkages and supporting literature to what may occur and to a lesser extent, what motivates the European position with respect to Greece. Contagion is on people's minds.

Post-Storm Analysis: How Weather Events Affect Investable Indices and Sectors

Learn how major weather events impact investors and explore how this FactSet historical analysis provides a basis for...

By Kristina Bratanova-Cvetanova | Risk, Performance, and Reporting

Stress Testing Amid Rising Fears of an AI Bubble

Explore FactSet's stress testing strategies for risk managers amid AI bubble concerns, comparing current market sell-offs to the...

By Kristina Bratanova-Cvetanova | Risk, Performance, and Reporting

Why Are Top Companies Rushing to Issue Convertible Bonds?

Learn the reasons behind the staggering growth of convertible bonds as investment vehicles for both hedge fund strategies and...

By Tom P. Davis, CFA, PhD | Risk, Performance, and Reporting

Is Your Buy-Side Reporting Strategy Aligned with Client Expectations?

Is your buy-side reporting strategy aligned with client expectations? Discover FactSet survey insights on data, automation, and...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.