The Chinese Yuan's devaluation in recent weeks has deepened fear of a major China economic slowdown and its collateral damage to the global economy. Much of the media's attention has focused on the headwinds multinationals will face as their Chinese customers reduce consumption and the additional drag on translated revenues caused by a weakening Yuan.

Given that the weightings of multinationals in many global equity benchmarks and investment portfolios are likely to be significant, how can investors effectively manage exposure risk to China?

As a test case, we created a three-step process and applied it to the S&P 500.

First, it's imperative for investors to identify which companies have high China exposure. For this study, we used "% revenue exposure" as a proxy for geographic exposure. After using FactSet GeoRev data to quantify China revenue exposure for all S&P 500 companies, we ranked them from highest to lowest. Any company that derived 20% or more of its revenues from China was categorized as highly China exposed.

Second, we devised several weighting modifications on the highly China exposed companies to reduce their impact on the S&P 500. The modifications were underweighting them by 50% or 75% relative to their original index weights or removing them completely from the S&P 500 portfolio. Hence, we created three modified S&P 500 portfolios that tried to mitigate China exposure risk via weighting reduction or complete avoidance.

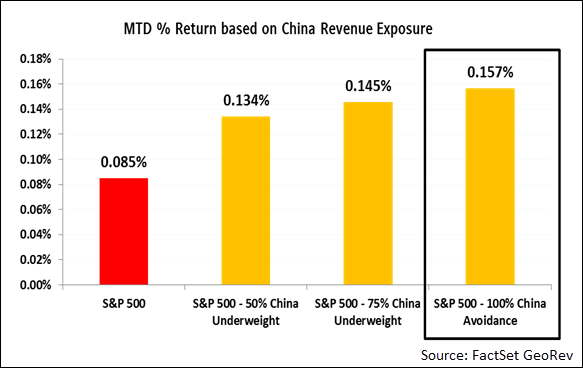

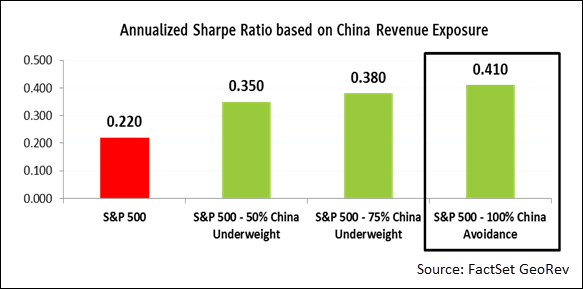

Third, we backtested the performance of these three modified portfolios against the S&P 500 month-to-date (July 31, 2015 to August 17, 2015) and analyzed whether the returns and Sharpe Ratios of the modified portfolios outperformed.

The image below displays our backtested results. In month-to-date returns, all three modified portfolios outperformed the S&P 500; in other words, both underweighting and complete avoidance of the highly China exposed companies seemed to improve returns. Furthermore, the less weight assignedto these highly China exposed companies, the better the results.

In the annualized Sharpe Ratios of these three modified portfolios, we see that results steadily increased as less weights were assigned, achieved through a combination of higher returns and lower standard deviation of returns.

From these results, it appears that geographic revenue exposure could serve as a good proxy for exposure risk to China. And in the context of the S&P 500, both the returns and annualized Sharpe Ratio almost doubled by simply eliminating 17 stocks with high revenue exposure to China while keeping all major portfolio characteristics essentially the same in terms of market beta, size, and style.