When evaluating a strategy, capacity is usually overlooked, but performance might be considerably affected by the invested capital. For instance, strategies involving small cap companies can appear very profitable at first sight, but their performance can deteriorate fast as assets under management (AUM) scale. The main reason is that small cap companies are usually associated with more stringent liquidity constraints, which makes them more difficult to trade without moving their stock price. A potential solution? Propagate the signal across economically-linked companies to increase portfolio size!

Quantifying Company Sentiment

Uncovering business relationships among companies can help build profitable investment strategies. No company operates in isolation; they are all part of an ecosystem consisting of suppliers, competitors, customers, and partners, also known as economically-linked companies. Understanding a company’s business relationships informs investors about their business opportunities and risk exposure. For example, looking at the sentiment of one company can tell you how the market might perceive its suppliers or competitors, and this can be exploited to get larger and more scalable investment portfolios.

In a recent study, RavenPack set out to evaluate whether supply-chain and competitive landscape information provided by FactSet Revere Data could enhance sparse trading signals such as earnings sentiment — a signal we previously showed provided an edge over earnings consensus estimates.

Since earnings guidance or other earnings related news provides direct information about the future growth prospects of a company, we can also expect that it will impact those economically-linked companies that depend on it. This offers an opportunity to increase portfolio size by focusing on companies in its network.

Applying Sentiment to Strategy

When testing our spillover hypothesis, we found value in propagating the original earnings sentiment signal from source companies to both their suppliers and competitors. However, when we tested how the signal propagated from the source company to its customers, we identified limited value over time. Most of the positive performance, coming from the spillover alphas, was observed across small cap companies (i.e., Russell 2000). This isn’t too surprising, since such organizations are generally expected to rely more heavily on their economically-linked companies, while larger companies have more diversified business relationships.

To verify our strategy scalability hypothesis, we developed a backtesting framework that took into consideration both maximum allocation and liquidity constraints. This allowed us to analyze the behavior of different performance measures for different values of AUM.

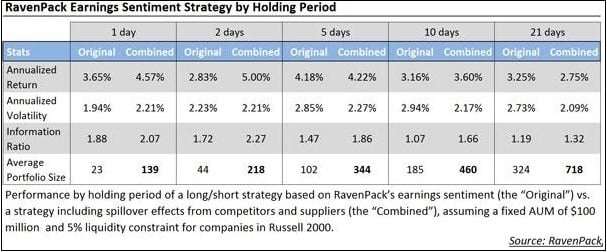

We show that by combining the spillover and the original strategies, we obtain a more frequent signal that is significantly less sparse cross-sectionally. This allowed us to create significantly larger and more scalable portfolios—increasing portfolio size by up to six times. Interestingly, our observed performance improvements scale with both higher AUM and longer investment horizons. Assuming AUM of $100 million (see table below), this translates into improvements in IR of up to 55%, depending on investment horizon—with two week holding periods providing the strongest results. With AUM of $200 million, the improvement can reach 85%.

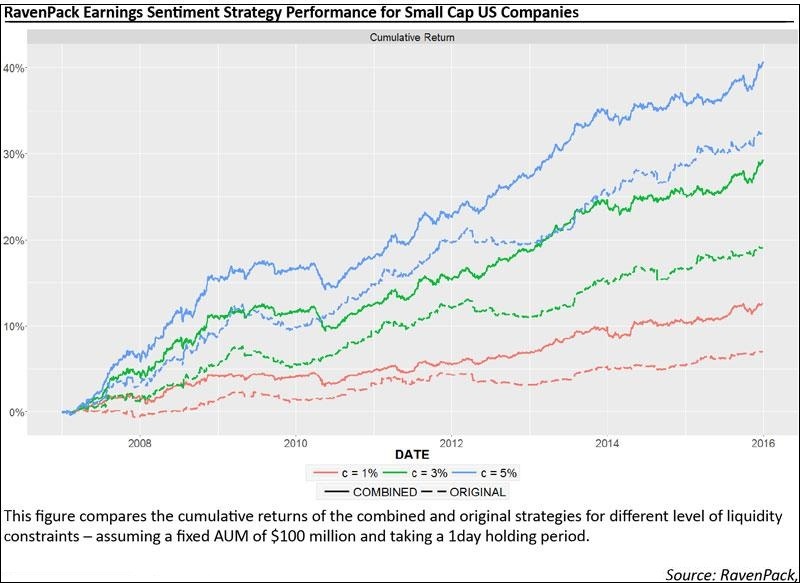

To summarize our findings, the figure below shows a comparison of the cumulative returns for the R2000 universe for the original and combined strategies. Assuming a fixed AUM of $100 million and liquidity constraints of 1%, 3%, and 5% of average daily trading volume, we show that the combined strategies all outperform their original counterparts, and that the outperformance has shown strong consistency over time.

All in all, supply-chain and competitive landscape information enhance cross-sectionally sparse signals leading to more scalable strategies.

This article was originally posted on RavenPack Blog.