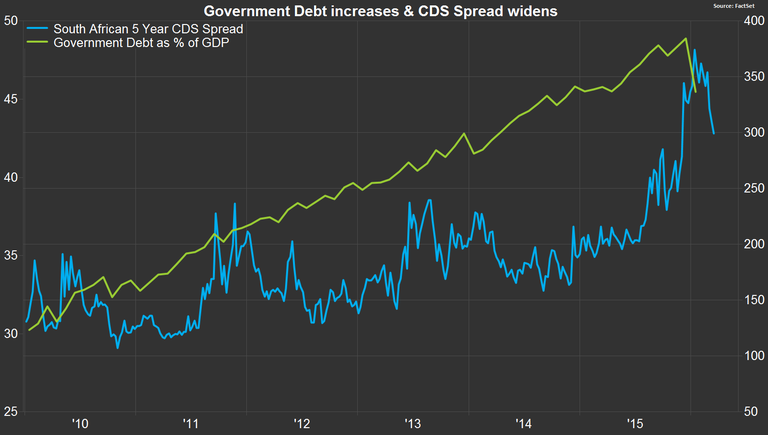

The last year has been filled with turmoil for Africa’s second largest economy: South Africa. President Jacob Zuma has been the subject of political controversy, firing two finance ministers in a matter of weeks in December 2015 and being met with accusations of corruption by the current finance minister, Pravin Gordhan. Meanwhile, economic growth has been under pressure due to weak global demand, electricity supply constraints, the worst drought conditions in a century, and falling commodity prices. Since Zuma took office in 2009, government debt has doubled to over 45% of GDP. Both Moody’s and S&P credit rating agencies have downgraded South Africa several times, and the country’s ratings now stand at BBB- and Baa2, respectively. The higher country risk is reflected in widening CDS spreads over the past year.

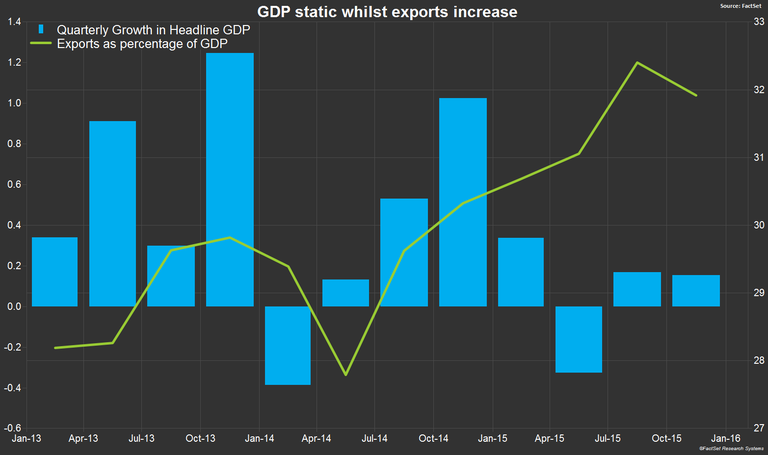

The National Treasury, International Monetary Fund, South African Reserve Bank, and World Bank are all forecasting economic growth of less than 1% for 2016. The bearish economic outlook has resulted in declining foreign direct investment. Combined with US Federal Reserve interest rate hikes and continued market turmoil in South Africa’s largest trading partner, China, investors and corporations alike have felt compelled to turn to overseas markets. In the Treasury’s recent budget review, GDP growth forecasts were 0.9% for 2016, 1.7% for 2017 and 2.4% for 2018, revised down significantly from previous estimates.

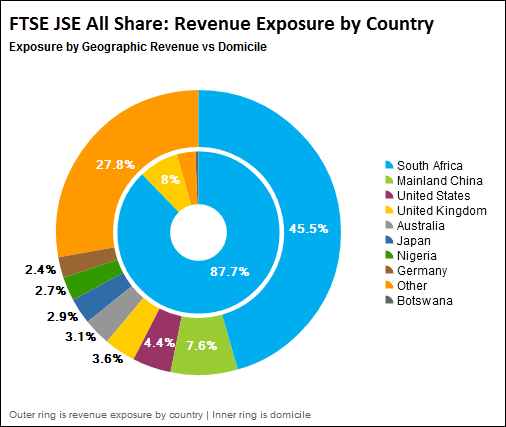

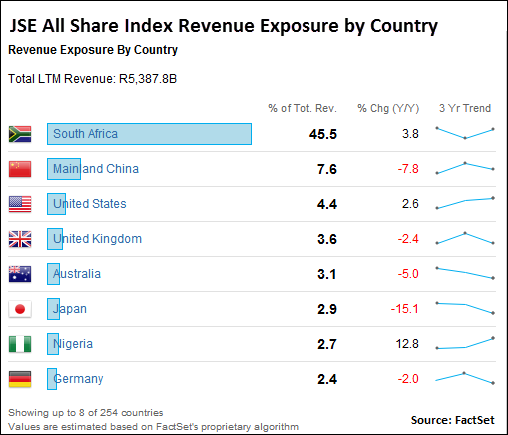

Dissecting company and portfolio revenue by geographic exposure is critical to understanding the true geopolitical risks that an investment represents. South African investors, restrained by the South African Reserve Bank’s offshore investment limits, may wish to increase international exposure through local entities with geographically diverse revenue. The primary local equity index, the FTSE JSE All Share Index (ALSI), is an integrated global index whose constituents generate revenue in 254 countries spanning developed, emerging, and frontier markets. While 88% of the revenue generation is domiciled in South Africa, only 45% of the 5,387 billion rand revenue is earned locally.

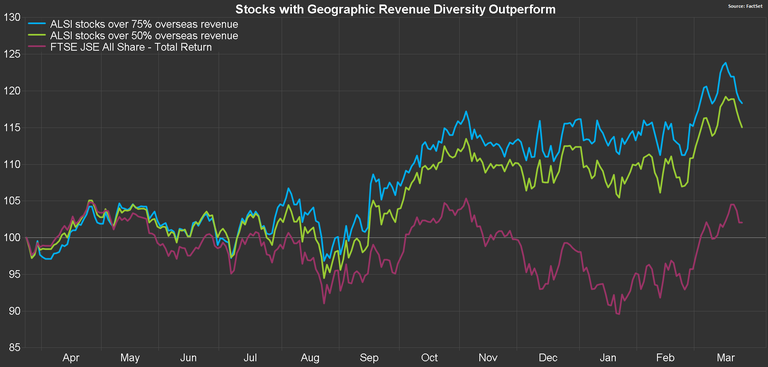

Using FactSet’s GeoRev database to identify the true revenue exposure of the ALSI constituents, we find 18 companies who produce over 75% of their revenue outside South Africa and 30 companies who earn over half of their revenue overseas. As a market value weighted composite, these companies have outperformed the ALSI considerably over the past year.

The composite of companies with greater than 75% overseas revenue outperformed the ALSI by 16%, and those with over 50% overseas revenue outperformed by 13%.

On January 11, the rand hit a record high of 17.83 against the US dollar, a depreciation of 58% from the 2015 low. Removing currency effect by denominating in US dollars, the relationship holds true.

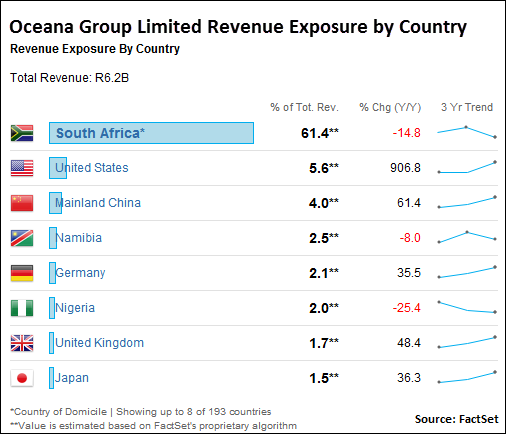

When we take a deeper look at the ALSI constituents, 51 saw a reduced share of revenues coming from South Africa in their most recent fiscal period versus the previous year, and 35 have reduced exposure year-over-year for the past three fiscal periods. One such company is Oceana Group Limited, which has increased operations most notably in Mainland China and the United States, by 61.4% and 906.8%, respectively. South Africa sourced revenue has fallen 14.8%.

The average company on the ALSI has seen a 2.55% reduction in South African revenue over its most recent two fiscal periods. The most notable sector was Consumer Durables, where South African revenue reduced from an average of 18.5% to 2.3% per constituent during the most recent fiscal year.

On a regional level, North America has aided the largest revenue growth, with the average company seeing a 10.8% increase in US-generated revenue share. The US remains South Africa’s second largest trade partner, bolstered by amendments to the Trade and Investment Framework Agreement in April 2015, an extension of the AGOA agreement. Revenue from China, dominated by commodities and raw materials, saw a 7.7% reduction for the average company.

With fears that the country may be downgraded to junk status, keeping an eye on the evolution of these trends will continue to influence the performance of local securities and the ALSI as a whole.