The global asset management industry has grown to record levels, according to a survey from the Boston Consulting Group as reported in the Financial Times. Assets under management increased to $74 trillion, the highest figure ever recorded by the survey. Profits in the industry have also risen, matching the historic peak in 2007, but net revenue growth has been slower than the rise in AUM.

There is a general air of cautious optimism in the asset management industry, and most commentators would agree that economic recovery is no longer a new concept.

So what is there to worry about? Plenty, actually.

This summer, FactSet brought together a group of senior executives from some of the largest asset management institutions and sovereign wealth funds to meet at the FactSet EMEA Symposium in Monaco. There, they discussed the key issues and outlook for the fund management industry. Guest speakers included Dr. Thomas Mayer, founding director of the Flossbach von Storch Research Institute, and Robert Mellor, Tax Partner and Alternatives Tax Leader at PwC in the U.K.

Search for Yield

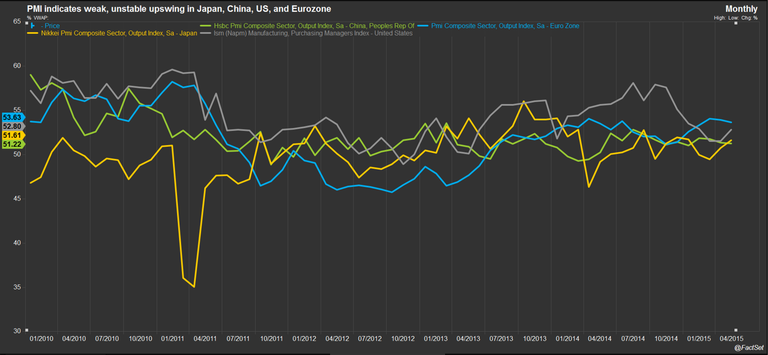

The search for yield in a low growth environment dominated the minds of most of the attendees, who seemed resigned to accept Dr. Mayer's view of the "New Normal" – an environment of low, unstable economic growth, characterized by short and weak recovery phases. Dr. Mayer went on to assert that equities were relatively inexpensive and presented the best long-term bet: "You have to be in equities. Bonds is not a place to be." Members of the roundtable agreed that it was difficult to allocate away from equities, but that under these circumstances allocation is critical.

Dr. Mayer propounded his theory that in this new environment, investment risk must be assessed in a different way: "The theory that 'volatility equals risk' is nonsense." Practical risk management should take into consideration factors such as the holding period and the quality of investments, and investors should be searching for stocks with a low probability of loss over the long term. This view polarized opinions around the group, since performance measurement tends to be short-term. It also raised the interesting notion of having to re-educate clients to aim for returns over a longer-term horizon, instead of short-term gain.

Surviving the Regulatory Environment

Everyone agreed that the proliferation of regulation and reporting requirements has increased the cost of doing business for asset managers. Although they widely accept that the environment is here to stay, asset managers are still expecting the cost of current and future regulatory initiatives to impact their businesses significantly. The industry needs to stay aware of the entire regulatory environment, since the myriad of regulations can affect asset managers both directly and indirectly.

Many asset managers are reviewing their processes in light of the regulatory environment that they now have to operate within. Spend on technology and data management is increasing as institutions look to comply with evolving requirements in the most cost-effective way. Compliance requires quality data that is organized and then distributed and shared.

We are also seeing a new trend among our clients as asset managers look to capitalize on the data they are receiving from us for regulatory reporting purposes. Not only is much of the same data often required to satisfy multiple regulations, but that very same data can also be used to provide deeper insight in research and analysis. We see from many of our clients that investing in robust and consistent processes to capture the data required for regulatory reporting can help turn that data into an asset that adds value beyond its specific application.

Growth, Scale, and Efficiency

Mellor painted a picture of an industry in the throes of significant change in the years to come. PwC's report Asset Management 2020, A Brave New World depicts a rapidly changing landscape marked by a huge rise in assets, shifts in the investor base, and increasing pressures on the asset management industry. However, Mellor issued warnings about how the industry will need to change to prepare for future challenges and turn them into competitive advantages.

Continued globalization, a trend towards multi-asset strategies, rising costs, and changing fee models will require asset managers to review their processes and strive for efficiencies. Investments in technology and data management, particularly leveraging external expertise through outsourcing, will become increasingly necessary. Integrated technology and quality data will not only help drive robust investment decision-making, but will enable more efficient and accurate reporting and disclosure to investors and regulators.

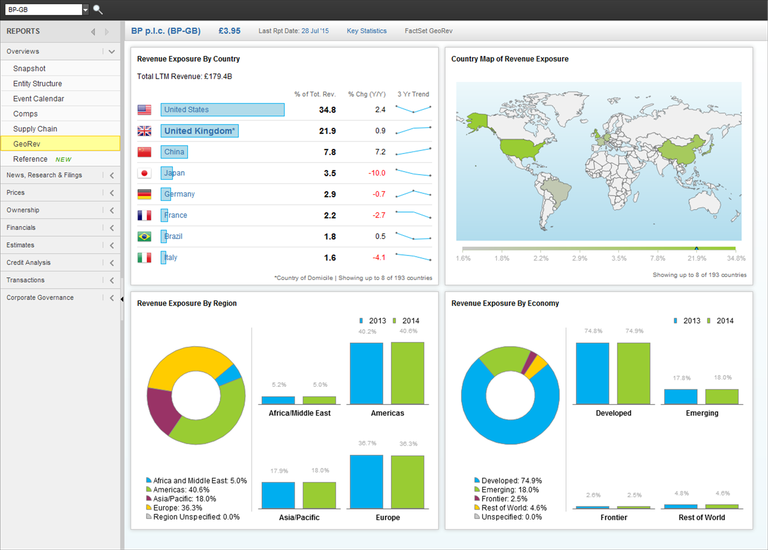

We've seen this trend rise among our clients as well, as asset managers strive to control investment risk and avoid reputational risk. Understanding a company's relationships and exposures is becoming increasingly necessary for asset managers who want to mitigate potential geo-political risks and meet the changing demand of investors with a growing interest in ethical and social factors. Moreover, asset managers will be required to understand the risks and exposures of their entire portfolios and quickly identify their positions across multiple portfolios. In the past year, we've seen a tremendous uptick in clients addressing these questions through FactSet GeoRev data, which correlates revenue to a normalized geographic classification system of nearly 300 countries, areas, regions, and super-regions.

There is no doubt that the financial crisis and recession have forced change on the asset management industry. But this is not the end of change. The megatrends impacting the world's economy and demography will present many new challenges and opportunities, and asset managers will need to adapt and continue to evolve to survive and prosper in the years to come. How asset managers handle growth opportunities and increased pressures while simultaneously innovating and responding to the evolving demands of investors and regulators will shape and define their future success. What has already been will likely be over-shadowed by what is to come. We should then, perhaps, see this as the dawn of a new era in the industry.