We’re almost at the midpoint of the year, and it’s clear that three key themes are dominating the ETF landscape, at least as far as investor interest and product launches are concerned. But are these themes actually good for investors? As with most things, it depends.

1. Smart Beta: The Elephant In The Room

Unless you’ve been living in a cave, you’ve likely heard the term “Smart Beta.” But if you can’t figure out what it means, you’re not alone. It’s a marketing construct used by issuers to package quantitative, or even just structurally interesting, equity and fixed income products.

At its core, Smart Beta means investing in something other than the total market and weighting your stocks by anything other than market cap. It’s a fine definition that has the unfortunate quality of capturing all kinds of funds. Investing based on low P/Es? Congratulations, you’re not only a devotee of the legendary 1930s investor Ben Graham, you’re also incorporating Smart Beta according to this definition. Ditto growth investing, equal weighting, or even price weighting, like the Dow.

Overall, these smart and kind-of-smart ETFs have become a driving force in the ETF industry. We count some 811 funds out of the 1,796 ETFs currently on the market as Smart Beta, with nearly 25% of total assets ($526 Billion) falling into this category.

But do they actually deliver? As you can imagine, the answer varies wildly. Value and Growth rarely work at the same time, but both are considered the simplest of Smart Beta. For that reason, the ETF industry has put a lot of effort into developing multi-factor Smart Beta ETFs that use more than single factors to pick their stocks. As of the end of May, there were 42 such funds with five-year track records. Only eight showed any statistically significant alpha—and three of those eight were negative alphas!

So despite the $39 billion that’s flowed into Smart Beta products this year, most investors would be wise to approach them with watchfulness and a healthy dose of skepticism.

2. Hedged Equity: The Smartest of the Smart?

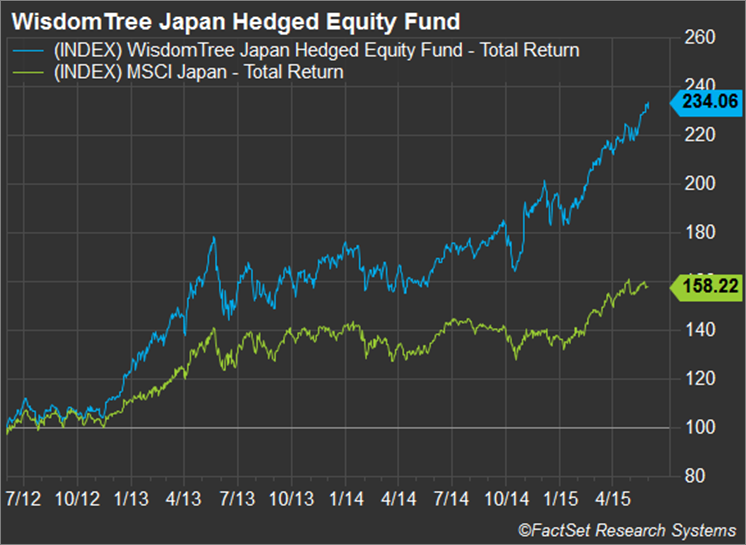

In many investors’ eyes, the smartest of Smart Beta strategies have been those funds that simply invest in international equities, but layer on currency forwards in order to remove the implied long position in the underlying currency. While these strategies have been around for years, it wasn’t until 2013, when WisdomTree started aggressively marketing its Hedged Japan ETF (DXJ), that they really caught investor attention.

The combination of a roaring equity market and a rapidly devaluing currency made the bet, which hedged exposure to the yen, one of the trades of a lifetime. Investors who caught the train early have had three-year returns of over 240% (75% above their unhedged counterparts).

The magic also worked in other markets where the strong dollar ruled and the cost of hedging was low or even negative. The cost of hedging the dollar is cheap if the prevailing interest rate for the dollar is equal to or higher than the interest rate of the target currency. This has made the euro and the yen—where zero interest rates rule the day—ground zero for currency hedging arrangements.

A few years ago, there were essentially no assets in currency-hedged ETFs, whereas today there’s some $62 billion. More than half of that has arrived in just the last five months. The bloom may be coming off the rose, however, as May flows were the weakest we’ve seen for currency-hedged equity in some time. It seems many investors favored more traditional exposures, like the unhedged iShares MSCI EAFE ETF (EFA), which pulled in $1.5 billion in May alone.

3. Bespoke ETFs: Get It For Wholesale

In the midst of all the Smart Beta and currency hedged hype that’s dominated the last year, it’s worth pointing out another trend underneath the surface which can be tricky for investors to navigate—bespoke ETFs. The ETF market is now so large and robust that ETFs are replacing structured products as the vehicles of choice for unique exposures.

It all started in the summer of 2013, when Blackrock teamed up with the Arizona State Retirement System (ASRS). ASRS wanted exposure to the MSCI “Quality Mix”—a Smart Beta index designed to replicate at least part of the magic captured by Warren Buffet, in a low-cost package. In the old days, such exposure would have been run in a separate account, but Blackrock instead partnered with ASRS to create a custom iShares ETF (QUAL) to house the MSCI index. As part of the partnership, Arizona seeded the brand-new ETF with an unheard of amount of week-one capital—over $100 million, versus the usual $5 or $10 million most ETFs start with.

The strategy worked, and QUAL now has over $1.1 billion in assets.

It worked so well, in fact, that is spawned a slew of similarly custom ETFs. Vident launched a fund (VIDI) specifically to be sold to Ronald Blue & Co. clients, matching a values-based total market strategy to that values-based advisory business. It quickly gained hundreds of millions in assets. There have been dozens of examples since, the most recent being the iShares Exponential Tech ETF (XT), which was made in partnership with headline advisor Ric Edelman of Edelman Financial Services. The fund raised more than $550 million in the first two days it was on the market, presumably from Edelman clients.

There’s nothing exactly wrong with this; the ETF wrapper is great at packaging unique exposures and getting them into the hands of any investor with a brokerage account. But the pitfall of these custom strategies is that they can have odd trading patterns. Funds like VIDI, for instance, often trade less than 20,000 shares on a given day, despite huge assets. These funds start with tons of buzz and lots of volume and then stagnate, raising questions about how liquid the ETF will be when investors head for the exits.

Sleep With One Eye Open?

Investors would do well to remember that when you read about a hot new product that seems too good to be true, it pays to be extra careful. Many Smart Beta products—bespoke or not—are in fact based on sound academic research, but that research generally isn’t for the faint of heart. Many of these strategies are designed to squeeze out small excess returns over long holding periods, which can require a deep commitment during a down market.

Moreover, every new ETF that launches comes with beautiful backtested results, otherwise it never gets out of committee. The question of whether it can deliver in the real world is another issue entirely.