As we saw in our global survey of Heads of Performance, the relationship between the performance measurement team and the front office can be combative at times. Fund managers have their own—indicative—performance and risk systems, and do not always enjoy being challenged with inconsistency.

Performance measurement teams need to smooth the path by reducing challenges, driving consistency, and removing that indicative nature where possible. This is achieved through systems and communications that increase confidence in the source, ensuring that the performance measurement function is a trusted advisor to the front office.

In all dealings with the front office, it is important to remember that the performance measurement and risk teams are, by necessity, independent. Just as sports leagues have independent referees to keep score, there is good reason why fund managers do not report on the funds they run. Fund managers should recognize the value of oversight, checks, and balances—but that doesn’t mean the relationship cannot be collaborative.

Their Data Vs. Your Data

Most fund managers have their own systems and proprietary processes. Any fund manager worth his salt will know that his Japan position has been hurting this month or that a favored holding has had a profits warning. It’s the unseen and the themes that fall outside of a fund managers’ practice that are important.

Examples might include less active securities, held to give exposure or track benchmark bets, but not performing as expected, or a fall in the market that shows a position to market cap to be more (or less) exposed than imagined. Therein lies the value of looking at the big picture that attribution reports provided.

By separating out the positions held in the portfolio, the benchmark and the mutually held positions, you can lend additional insight into the positions that a fund manager is holding.

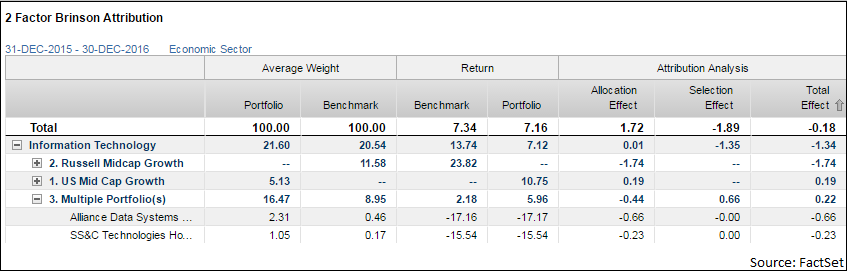

In the example below, the manager has a slight overweight to Information Technology, with -1.35 of stock selection for the year. An additional layer of analysis quickly reveals that she had an overweight of almost 2% against the benchmark in Alliance Data Systems, a security that did not perform well in 2016. This hurt the portfolio for the period.

Continuing with Tech and separating the out-of-benchmark bets in the portfolio shows where the manager has added value in stock selection.

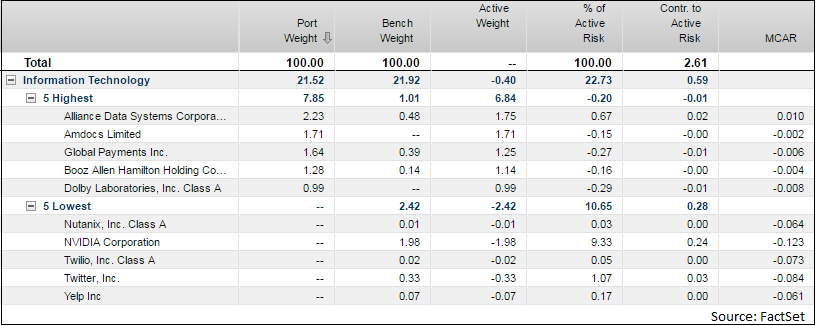

Taking a deeper dive into risk metrics and valuation analysis can ensure that these out-of-benchmark positions didn’t negatively impact the risk of the portfolio.

Below, we can see that the addition of Dolby to the portfolio had minimal impact on the risk despite being an out-of-benchmark bet.

For most fund managers, basic attribution analysis is a check and balance to the figures revealed by their own system. Nevertheless, it is important in a number of respects.

First, it is independent, and so provides a crucial counterweight to a fund manager’s own analysis and conclusions. The systems used may differ slightly, and each may pick up findings that the other hasn’t spotted.

For instance, performance attribution may reveal unintended or over-concentrated risks, or other nuances not brought out by a fund manager’s risk systems—market capitalization or FX tilts, or valuation or duration biases. Is a portfolio particularly vulnerable to oil prices, for example, or to a rise in bond yields? Has a fund manager made money by being in the right part of the market, e.g., in cyclical stocks like mining or banks, at a time when they were favored? Or was performance simply from the quality of the manager’s stock picking?

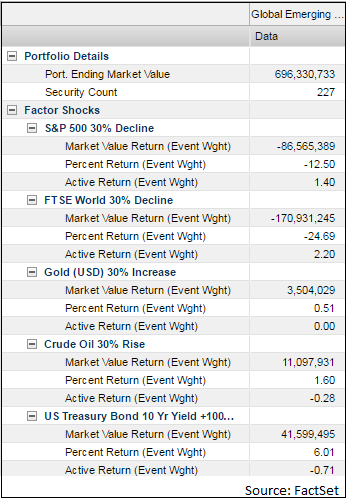

The ability to stress test a variety of market factors allows the front office and performance team to have an open discussion about the portfolio’s vulnerabilities.

The example below demonstrates how a portfolio would suffer from a 160-bps loss if oil prices were to rise 30%. But on a relative basis, it would be up 28 bps, indicating that the portfolio is negatively exposed to a rise in oil prices but overexposed versus the benchmark. A 100-bps rise in the U.S. 10-year yield would result in a 6% increase in the portfolio, but on a relative basis, the portfolio would be down 71 basis points. So for oil, the 100-year Treasury yield and gold, the portfolio is not exposed by more than 100 bps.

Granularity and accuracy of data should create a more fertile exchange between the front office and performance teams.

Relationship Management

Relationship development is a key success factor for any performance team. If your performance team can’t talk to the front office, the process will break down, and everyone will suffer. Fund managers have different approaches, and what is important to one may not be important to another.

A good understanding of each manager’s processes, and what they mean for the performance and risk team, is vital to a strong relationship with the front office.

Fund managers might want to consult on risk management and undertake scenario planning. They may want answers questions like, "If I bought this position, what would it mean for the inherent risk in my portfolio?" They may also want to pick up trends in the wider market, such as whether there is a discernible trend for value over growth stocks and how that has influenced performance.

Understanding the way a fund manager likes having statistics presented will smooth the relationship. Accurate and timely data is of course a vital component of long-term trust as well.

Ultimately, the relationship with the front office should be one of mutual support and benefit. It just takes a little effort to get there.