The movement of funds from active to passive has been well documented, but at the moment there is still much more money invested in active funds. If active managers want to defend their value proposition, they need to communicate to their clients why they deserve higher fees than passive strategies. In this new landscape, the traditional means of explaining performance may no longer be sufficient.

The most common approach to decomposing excess return is to use one of the various flavors of the Brinson-Fachler attribution model. This approach has several advantages. Not only is it intuitive and straightforward, with performance broken down into the return coming from asset allocation (Allocation Effect) and stock picking (Selection Effect), but it is widely deployed across firms, providing an industry standard for feedback on which elements of the portfolio construction process are working and which are failing.

Brinson-Fachler Attribution Model in Practice

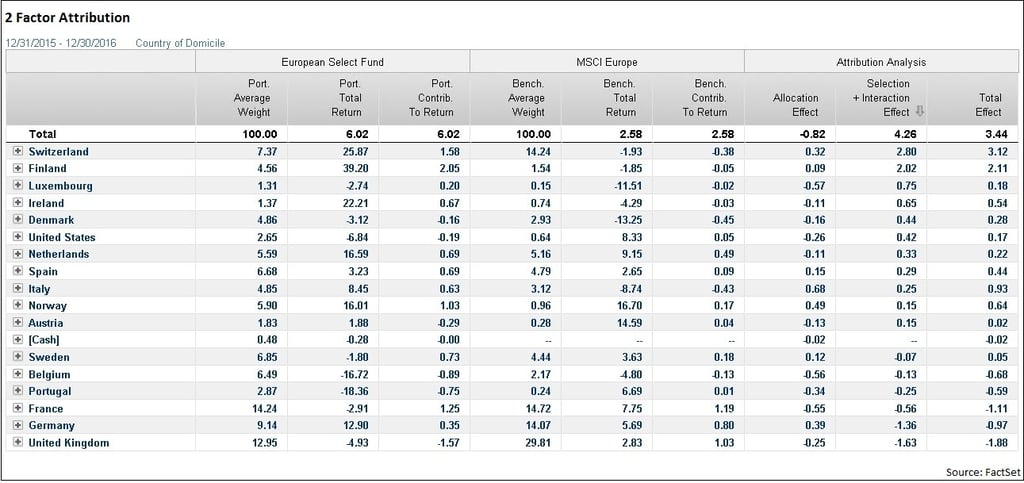

Despite its clear utility, Brinson-Fachler attribution has some drawbacks. As an example of how relying solely on this method to understand returns may leave active managers exposed, let’s consider this portfolio:

The report clearly shows that this manager was successful when picking stocks. Selection + Interaction Effect of 4.26% was key in achieving an excess return of 3.44%, with Allocation Effect a drag on relative performance at -0.82%. Portfolio returns for Switzerland (25.87%) and Finland (39.20%) in particular far exceeded those in the benchmark (-1.93 and -1.85, respectively). For more, see our previous post on Equity Attribution and the Delicate Art of Interaction.

An active manager with a bottom-up, security selection investment process might be happy to use these results as justification for his active management approach when talking to clients. However, country exposure is not the only factor that can impact performance. If we analyze the same portfolio over the same period using a sector instead of country classification, these are the results:

This analysis tells the opposite story; the manager’s outperformance is almost entirely due to his asset allocation decisions (Allocation Effect of 3.08%), with a comparatively small fraction of excess return coming from stock selection (Selection + Interaction of 0.37%). Although Selection Effect shows he picked Financials stocks successfully (2.68%), the equivalent numbers for Consumer Discretionary (-1.26%), Industrials (-1.50%), and Materials (-1.86%) indicate a major drag on performance. For a manager that is selling his expertise in picking outperforming securities, this version of the report leaves the impression that his skill is purely in asset allocation and completely undermines the story told by the country attribution.

As a bottom-up stock picker, this manager may not be making decisions based on country or sector exposures, but these reports can highlight unintentional biases. The substantial overweight in Materials and Industrials accounts for the large Allocation Effect, since both sectors outperformed significantly (benchmark sector returns of 28.72% and 11.23% respectively, against a benchmark total return of 2.5%). To understand these biases, both reports are needed.

Behavior Modification

As a result, this fund manager is left with several problems. How can he reconcile the opposing stories that these two flavors of attribution analysis tell? How can he better understand whether his stock-picking decisions are adding value, while accounting for his unintended exposure tilts? And how can he ultimately prove his expertise to his clients, justify their faith in him, and defend his active management fees?

The solution (as outlined in later posts) is to use Brinson-Fachler attribution in conjunction with additional analysis. In the next installment, we'll examine how we can use a factor-based risk model to analyze performance across multiple factors, as opposed to the single factor approach Brinson attribution offers. Finally, we will look at a manager performance through an alternative lens, understanding portfolio construction as a function of positioning, buying and selling decisions, rather than of asset allocation and stock selection. Taken together, this will allow us to see how a multivariate approach, where all three methodologies for decomposing performance are considered, can provide better insight into the sources of return, both for a portfolio manager and his clients.

Read part two here: The Benefits of Active Management: How to Compete with Low-Cost Funds and Win